About Battery Electric Cars

Electric cars or battery electric cars are automobiles that are propelled by one or more electric motors, using energy stored in [lithium] batteries. Compared to our old friend the “ICE” or internal combustion engine vehicles, battery electric cars are quieter, have no exhaust emissions, and lower emissions overall. In the United States and the European Union, as of 2020, the total cost of ownership of recent battery electric cars is cheaper than that of equivalent ICE cars, due to lower fueling and maintenance costs. Charging a battery electric car can be done at a variety of charging stations; these charging stations can be installed in both private homes as well as public facilities. #Investing #Cars

Investing in Battery Electric Cars

From Investopedia: Investors interested in Battery Electric Cars have a variety of options when it comes to individual AutoMakers:

Tesla Motors

Auto-Makers such as Tesla Motors exclusively manufacture electric vehicles and may be directly invested in by purchasing stock. Companies within the automotive sector that manufacture vehicle parts or supply raw materials used in producing electric cars are another means of gaining portfolio exposure to electric cars. Another slightly less risky option is to invest in exchange-traded funds (ETFs) with holdings in securities related to electric vehicle production or electric vehicle parts.

Toyota

Some major automakers, such as Toyota, are investing heavily in electric vehicles and allow investors to choose both traditional and electric vehicles for their investments. Chevrolet and Nissan have also made notable electric car models available in the U.S. market. Investors should carefully consider available investment opportunities and evaluate the potential risk-return tradeoff offered by electric vehicles and the automotive industry.

Battery Electric Cars Battery-Makers

Polypore (Lead-Acid Battery Maker)

Many manufacturers develop auto parts for traditional and electric vehicles. Polypore International (PPO) produces lead-acid batteries used in both conventional and electric vehicles. This stock offers investors the opportunity to invest generally in the production of vehicle batteries. As electric vehicle and conventional vehicle usage grows, more batteries will be needed, and this company will likely benefit from increased global car demand.

Plug Power

Another battery company, Plug Power (PLUG), manufactures hydrogen fuel cell batteries used in electric vehicles and many other types of electronic equipment. These batteries may replace lead-acid batteries in forklifts. Plug Power batteries are also used outside of the automotive industry, giving the company a large market.

Lithium

Sociedad Quimica y Minera (SQM) is a major supplier of lithium, an element used in many batteries powering electric vehicles and other clean technologies. Investment in companies such as Polypore International, Plug Power, and SQM offers portfolio exposure to electric vehicles while also maintaining diverse holdings outside the automotive industry.

Battery Electric Cars – Exchange-Traded Funds

Exchange-traded funds that track electric vehicles are another possible opportunity for investors. These funds allow investors to purchase shares in funds that track electric vehicle industry development. Investments are spread across multiple companies, reducing investment risk and offering returns similar to the average returns of the entire sector. ETFs track gains and losses of stock indexes and are traded directly on the stock market in a means similar to stock trading. Just as in traditional stock trading, stop-loss limits may be placed, and dividends are paid to brokerage accounts.

Significant ETFs that include electric vehicle stock and supplier stock include QCLN and LIT. The First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) has Tesla among its holdings and includes other companies with green technology offerings. Global X Lithium (LIT) tracks lithium suppliers and battery companies. This fund’s most significant holdings include FMC Corporation, Avalon Rare Metals Incorporated, and Rockwood.

The Battery Electric Cars Industry

From USNEWS article: The success of the electric car industry has been years in the making, and there’s much more to come.

The electric car industry has been expanding for years, and stakeholders continue to invest billions into this burgeoning market.

While Battery Electric Cars is still a budding industry filled with opportunity, it’s one that also faces tough challenges, which leaves room for costly mistakes that could have other ramifications. Battery Electric Cars stocks rallying all year may have left some investors distracted from market challenges. The Battery Electric Cars market has quickly grown in a short period of time, creating a bullish market attitude; although, investors may want to balance this enthusiasm given the Battery Electric Cars risk and reward calculation.

As new players emerge, the Battery Electric Car industry has all the ingredients necessary for continued innovation. Here is what investors need to know about the Battery Electric Car industry if they are considering EV investments:

-

Battery Electric Cars global growth.

-

Factors driving Battery Electric Cars sales.

-

Market challenges ahead.

-

Battery Electric Cars stocks and investment risks.

Global Growth for Battery Electric Cars and the EV Industry

The Battery Electric Cars and EV industry in China has seen considerable growth within the last decade. By promoting EV usage through public policy initiatives and fiscal support, China has spurred EV innovation. China has seen a rise in its EV stocks such as Nio (ticker: NIO), XPeng (XPEV), Li Auto (LI) and Kandi (KNDI).

A July report from McKinsey & Co. found that Europe EV sales increased by 44%, marking the highest growth rate since 2016.

Europe has seen the strongest growth in EVs, according to McKinsey’s analysis. Its research also found that China saw a 57% decrease in EV sales and a 33% decrease in U.S. EV sales, while Europe saw a 25% increase in its market share – a stark contrast in Europe’s EV growth relative to other regions.

In the U.S., Tesla (TSLA) comes to mind as an electric car winner, but Mike Juran, CEO of Altia, says it’s the traditional original equipment manufacturers (OEMs) that will advance EV growth, “General Motors (GM), Volkswagen, Hyundai and Toyota (TM), will be the real drivers of EV growth,” he says.

“These OEMs have decided that the future is EV,” Juran, explains. “They have the financial position, a firmly established ecosystem of suppliers, the clout to enable the necessary infrastructure and an army of visionaries on staff to make their electric vehicle programs not only feasible but successful.”

Drivers of Sales for Battery Electric Cars

China has put public policies in place to address the concern of growing carbon emissions and air pollution. To regulate and reduce emissions, which in part come from traditional vehicles, China has dedicated public policy and fiscal support to grow its electric car market.

China has created incentives for EV use, which will aim at improving air health while expanding its market share. The Chinese government offers subsidies or tax breaks for electric cars that meet the government’s requirements. For example, these tax incentives cannot be used on luxury cars like Tesla or BMW. Rather, the EV cannot cost more than about $42,000 to qualify for the subsidy.

Since China’s government rolled out the subsidy initiative in 2009, the production and sale of EVs have been growing. While EV sales have lagged in 2019 and 2020 due to the pandemic, the secretary-general of the China Association of Automobile Manufacturers says he expects the number of new EVs to grow to five million by the end of the year. A news release says optimism of further growth despite the economic slowdown caused by the health crisis comes from China’s government extending subsidies into 2022.

Environmental consciousness has been a major investing theme in recent decades, one that has further been accelerated by the pandemic. A growing number of investors are making environmental, social and corporate governance, or ESG, investing a priority when shaping their portfolio. In the same light, Laurence Montanari, vice president of transportation and mobility industry at Dassault Systemes in Paris, says sustainability and controlling population levels are of top concern for consumers.

“Consumers all over the world are looking to purchase vehicles that are, simply put, more respectful of the environment and more personalized for their unique needs,” she says.

“By 2030, we expect the mobility market, including alternative powertrain (such as EV, plug-in EV and hydrogen fuel-cell and autonomous vehicles and mobility-as-a-service providers), to pass $1 trillion,” Montanari says.

Europe also has an ambitious climate and energy framework to push down carbon emissions in the region by reducing emission targets to foster cleaner transportation. Increasing environmental standards for passenger cars has led to higher sales of EVs in the region.

As the manufacturing of EVs has steadily become mainstream, the cost of EVs has been falling.

Tesla shaved down the cost of purchasing its Model 3, which starts at $37,900. The Model S starts at $69,420 and the Model X starts at $79,990. A big factor of falling EV prices has been the declining cost of lithium-ion batteries. TSLA plans to mine its lithium, which will further drive down the cost to manufacture EVs and bring them to market at a lower cost.

But the fall in lithium prices isn’t unique to Tesla. Montanari says. One key reason for EV growth can be attributed to the falling price and increased efficiency of batteries.

The price per kilowatt-hour for lithium-ion battery packs has dropped from $1,183 in 2010 to $156 in 2019, according to BloombergNEF data. Experts say we can anticipate a further drop in prices in the future.

Challenges Ahead for Battery Electric Cars

In the earlier stages of Battery Electric Car development, there were concerns about the cost of the car. This has been addressed as the costs to manufacture EVs have declined but price remains a challenge since the average consumer may not be able to afford the price tag despite tax incentives that some countries provide.

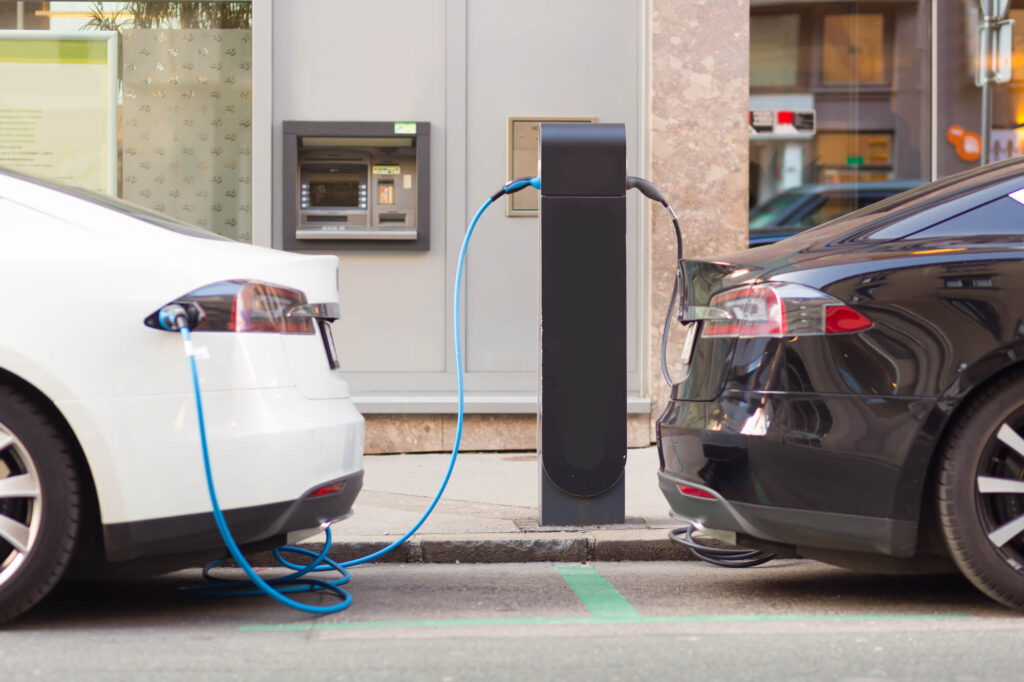

Players in the EV industry may need to put investment toward the widespread adoption and application of EVs. As the EV market continues to grow globally, the demand for charging stations will grow.

At present, there are concerns over developing charging stations and more broadly a framework around standardizing charging facilities for EVs. To create a charging infrastructure for the public to easily adopt, there may need to be some sort of coalition to design, build and finance the stations for ease of public and private use.

Battery Electric Car Stocks and Investment Risks

Below is some of what we highlighted in our previous post on our blog: Electric Vehicle ETF Strategy

While EV stocks are currently hot on the market, making them seem like an absolute buying opportunity, investors must keep the risks and challenges top of mind. These high-flying stocks hold record valuations, which may have some investors thinking they’re in a bubble.

Tesla stock has grown more than 600% year to date and the company has a market capitalization of more than $600 billion. Investors continue to have faith in TSLA despite its high market value. While second-quarter revenues were flat, Tesla’s first and third-quarter revenues were up 32% and 39%, respectively. For its annual battery day, Tesla unveiled a breakthrough battery design, outlined goals of reducing the cost of electric cars and released new self-driving vehicles. Many investors are enamored by CEO Elon Musk’s creative vision and the innovation that the company has displayed over the years, which is reflected in its products.

Nio, the Chinese premium electric car startup company, based in Shanghai, has also seen explosive growth in 2020. The stock is up more than 1,100% this year, standing at a market cap of $61 billion, right in line with General Motors’ (GM) market cap of $63 billion. While starting the year on shaky ground in the first quarter, Nio made up for losses in the second quarter, with a 146.5% increase in EV sales from last year’s quarter and another 146% increase in sales in the third quarter. While the market may put the brakes on the stock’s momentum, Nio is a serious competitor in developing and manufacturing electric cars in China.

Nikola (NKLA) is an example of an EV stock that soared earlier in the year before taking a nosedive. After a short selling report called out NKLA for deceiving investors about the performance of its electric truck and the technology behind it, stakeholders quickly backed out and the stock fell up to 13% on the news and is down almost 47% over a three-month period. Even though there are mixed market sentiments on whether NKLA can make a comeback, this is a case of how a high-flying EV stock can quickly lose.

Investors who want a stake in this industry without taking on too much risk should think about turning to an EV exchange-traded fund, such as the iShares Self-Driving EV and Tech ETF (IDRV). The fund has exposure to EV companies as well as the information technology and auto sectors, giving it elements of diversification. Some of IDRV’s top holdings include Tesla, Apple (AAPL) and Toyota. IDRV’s market value is about $42 per share, with an expense ratio of 0.47%. It’s up more than 50% since March’s market sell-off.

This EV ETF can be suited for an investor who wants a share of the Battery Electric Cars market competition but might feel skittish about owning individual EV stocks.

Bottom Line

When it comes to investing in Battery Electric Cars, investors should weigh the pros and cons. To keep taking revolutionary steps in becoming a mainstream product that captures consumer confidence, the Battery Electric Car industry will likely continue investing in itself to improve ease of use and also to overcome industry challenges. This investment comes with a heavy price tag, but, as with any investment, the risk may be worth the reward.