5 Tips for Year End Planning

The end of the year provides a number of planning opportunities and issues to consider. Year-end topics can include:

Tax Planning,

Investment and Retirement account Review,

Charitable Giving,

Cash Flow, Spending Plan, and Savings,

Risk Management and Insurance Planning,

Estate Planning

What Issues Should You Consider Before The End Of The Year?

Here’s a link to our #YouTubeShorts video for this post.

In this Year End Planning Checklist, we cover a number of planning issues that you need to consider prior to year-end to ensure you stay on track, including:

-

Various issues surrounding investment and retirement accounts including matching capital gains against any investment losses in taxable investment accounts and confirming that all RMDs are taken.

-

Tax planning issues including strategies dependent upon your prospects for higher or lower income in the future. You will also want to review where you sit relative to your tax bracket as this is a good time to make moves to fill out brackets for the current year that also might prove beneficial down the road.

-

If you are charitably inclined, there are several strategies that will also help reduce your tax liability depending on your specific situation.

-

If you own a business, tax reform has created some opportunities surrounding pass-through income from your business to your personal return. Accelerating or deferring business expenses presents another planning consideration for you.

-

It’s wise to review your cash flow and spending plan as you near year-end to see if you can fund a 529 plan for children or grandchildren or to see if you can save more in an employer-sponsored retirement plan like a 401(k).

This is a comprehensive Financial Planning Checklist of the types of year-end planning issues that all DIY Investors can use to ensure you consider and take advantage of opportunities in the current year and beyond. If its too late for you to work on your financical plan in 2022, take a look at our BONUS Financial Planning Checklist to get you started in 2023!

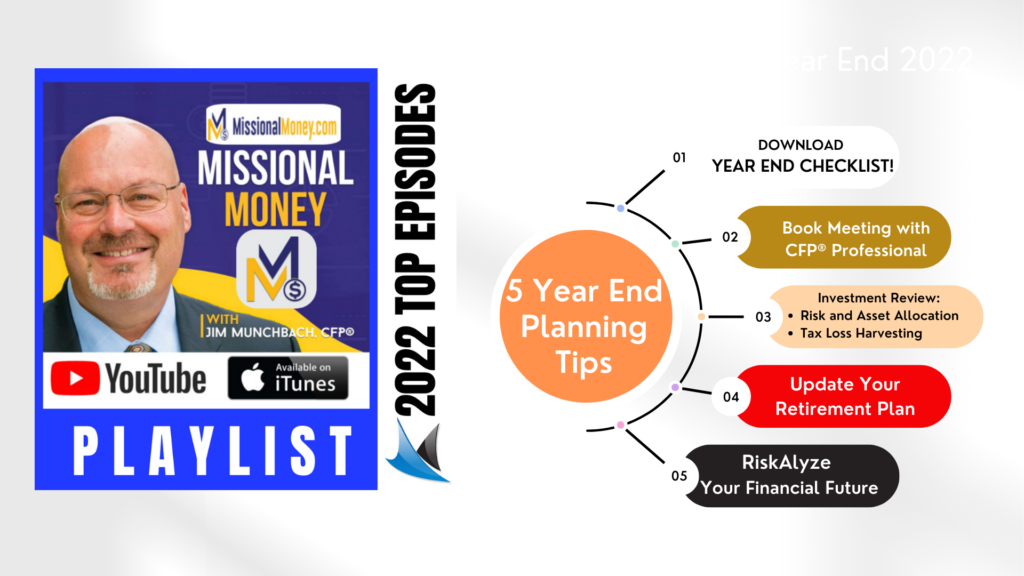

5 Tips for Year End Planning

-

Download the Year End Planning Checklist – Click Here

-

Book Meeting with CFP® Professional Click Here for Free CFP Consult

-

Investment Review – Click Here to Get Your Risk Number

-

Update Your Retirement Plan – Click Here to Create Your Plan

-

RiskAlyze Your Financial Future – Click Here to Get Ready for 2023

-

BONUS – Click Here to Download Planning Checklist for New Year!