Week 12: The Blueprint for Financial Success

-

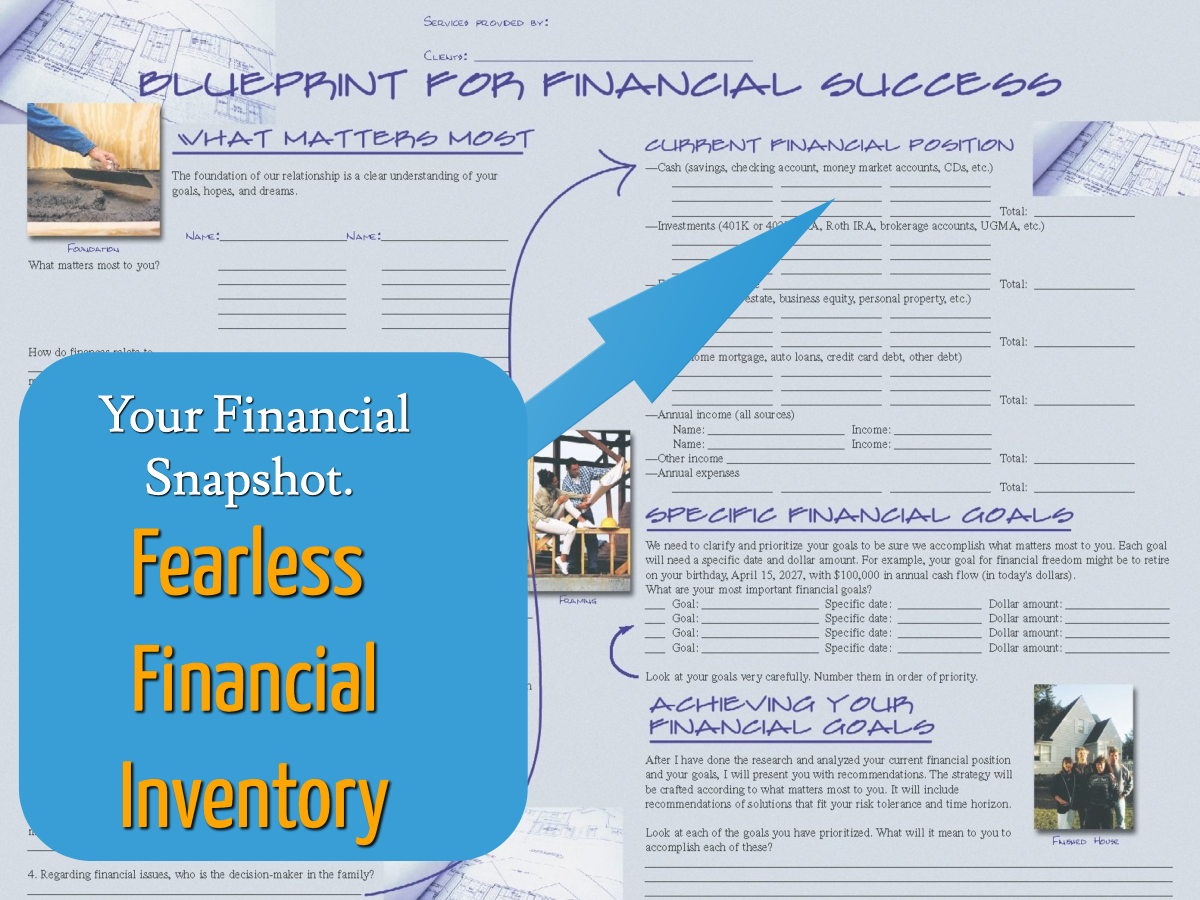

Open your plan and take a screenshot of each section in your Blueprint

-

As you consider the goals you have on your Blueprint, write a brief summary to describe how your goals are aligned with your vision, values, and purpose.

-

Using the FREE TIC Outline, write a summary of what you learned this semester about financial planning in the context of each of the 7 elements of financial planning.

NOTE ABOUT THE AUDIO: Today I tried out my new SYNCO Wireless Mic system. It sounded great on the locally saved video file and it sounded pretty good in Zoom. However, when it got live streamed to YouTube, the mic was way too hot! Sorry about the peaking. I had the gain set way too high.

FREETIC Financial Planning Review

FREE TIC is a simple acronym to help us stay on track and include the necessary components of a financial strategy, but remember to tailor your presentation to reflect the goals and dreams of your clients. Those with significant resources (about twenty-five percent of my clients) have different priorities:

FREETIC Stands for…

F=Financial Independence (Retirement Planning)

R=Risk Management (Insurance Planning)

E=Estate Planning

E=Education Planning

T=Tax Planning

I=Investment Planning

C=Cash Flow Planning

—Financial freedom (or retirement)

Some people want to work the rest of their lives, but others eagerly anticipate retirement so they can travel and devote more time to hobbies and their families. And some people fear the prospect of retirement because they have heard reports of the impending collapse of Social Security and the rising costs of long-term care and Medicare.

Whether people actually quit work, continue working, or change vocations to become full-time volunteers, they need a clear plan to achieve financial freedom and accomplish their dreams.

—Risk management

We deal with many risks in our lives. These risks range from minor car accidents to catastrophic injury or death. Our experiences of long-term illnesses and disability can cause severe financial hardships, and they can be a burden on those we love. Some of the pain can be alleviated with properly planned insurance.

—Education planning

It is important to start putting money aside for college as early as possible. There are many options, each with specific features. Education planning can be challenging because of the complexities of tax considerations, management fees, parental income limitations, and other issues. For example, some accounts charge a penalty if the money is not used for college costs. Saving money, borrowing money, and financial aid are some obvious ways to pay for college.

Your overall financial strategy should include solutions that insure your children will be able to attend college to achieve their dreams.

—Estate planning

Estate planning is a process that determines how to distribute your property during your life and at your death according to your goals and objectives. Without advance planning, more of your assets may go to the federal government in taxes instead of the people you love.

The issues that will affect your estate include taxes, probate, liquidity, and incapacity. Your strategy can consist of solutions that are simple and inexpensive (e.g., a will or life insurance). If your estate is large, however, the process can be complex and expensive, involving professionals in estate planning. Even modest portfolios, however, can grow into large ones if they are managed properly, so every person needs to consider estate planning, either now or in the future.

—Tax planning

The goal of tax planning is to minimize federal income tax liability while maximizing the after-tax return on investments. Typically, deferring some income in a 401k, 403b, deductible IRA, or other tax-advantaged accounts reduces taxable income. Roth IRA’s are excellent vehicles for many Americans to save for tax-free income.

Each person’s tax planning strategy is based on individual income; solutions that reduce taxes and offer tax-free growth are often appropriate. Some individuals need expert tax advice in order to design the best strategy; but standard solutions work well for most people.

—Investments

Almost limitless investment choices are available to every investor. Your strategy is designed to get the highest return within your tolerance for risk and your time horizon. No one can guarantee a profit or protect against a loss in a declining market, but dollar cost averaging (using automatic deductions) takes some of the guesswork out of investing. Asset allocation is the most important step in diversifying your portfolio. You can balance risk and return by spreading your dollars among different types of assets, such as stocks, bonds, and cash equivalents. Different types of assets carry different levels of risk and potential for return, and these investment vehicles typically don’t respond to market forces in the same way at the same time.

A long-term strategy will help you ride out the ups and downs of the market to build a sizeable investment account over your time horizon.

—Cash flow

Cash flow (or budgeting) is a process to measure, plan, and prioritize spending and saving. Your commitment to financial success requires a clear strategy for managing cash. An analysis of cash flow is the starting point in any financial strategy; it is not optional.

We will analyze your current financial position honestly and realistically, clarify your goals, and develop a clear financial strategy. On an annual basis, we will measure your progress. What matters most in your entire financial strategy is your commitment to success for yourself and the people you love.

Include between 400 and 600 words

-

How will you use what you learned in the future in each of these 7 areas of financial planning

-

Use any screenshots from your BayRock Plan if it helps to share what you learned

-

Be Clear about your goals

Going Deeper is an optional part of this assignment, but I will be very interested to know how you feel and what you believe about how money management impacts a person’s character.

How does a person’s vision, values, and purpose influence how they manage money.

How will your vision, values, and purpose impact your financial behavior?

Thank you for being a part of the work we did this semester in Personal Finance.

I hope some of what you learned leaves you touched, moved, and inspired to create a life you will love!

Let’s keep in touch.

Connect with Jim Munchbach on Social

🔹YouTube: https://www.youtube.com/@JimMunchbach @JimMunchbach

🔹LinkedIn: http://www.linkedin.com/in/JimMunchbach

🔹Twitter: http://twitter.com/JimMunchbach

🔹Facebook: http://www.facebook.com/JMunchbach

🔹Instagram: https://www.instagram.com/jimmunchbach

🔹JimMunchbach.com: https://jimmunchbach.com

NO ZOOM MEETING NEXT WEEK!