Purpose-Centered Financial Planning

For Women of Wealth, Business Leaders, and Financial Planning Professionals, visit BayRockFinancial.com

Purpose-Centered Financial Planning: Aligning Your Financial Goals with Your Values

In today’s complex financial landscape, many individuals and business owners struggle to find financial advice that truly aligns with their values and long-term goals. Purpose-Centered Financial Planning aims to bridge this gap by focusing on What Matters Most to clients, offering a holistic approach that integrates their personal and professional aspirations.

Check out The Salty Advisor Podcast.

Part One: The Ideal Career for Financial Advisors – Purpose vs. Reality

What Financial Advisors Want

Financial Advisors often start their careers with high aspirations. They aim to:

-

Provide honest, helpful advice

-

Build long-lasting relationships with clients

-

Make a meaningful impact on clients’ financial well-being

They seek a career that allows them to guide clients through comprehensive financial planning, focusing on clients’ best interests rather than corporate profits.

What Financial Advisors Actually Get

However, the reality for many Financial Advisors, especially those on Wall Street, is far from ideal. The industry is predominantly sales-driven, with a heavy emphasis on commission-based products rather than independent fiduciary advice. Advisors are often pressured to meet sales targets and quotas, which can conflict with their goal of providing genuine financial planning services.

Many firms promise comprehensive financial planning but deliver a service model designed to maximize profits through high fees, hidden agendas, and proprietary products. This can lead to ethical dilemmas and job dissatisfaction among advisors.

Part Two: What Women of Wealth Seek in Financial Advisory Services

What Women Want in a Financial Advisor

Women of wealth typically look for advisors who:

-

Understand their unique financial needs and goals

-

Offer personalized advice that considers their life circumstances, long-term plans, and family dynamics

-

Communicate clearly and provide holistic planning

-

Respect their input and decisions

What Women Actually Get

Despite their preferences, many women encounter advisors who focus excessively on charts, graphs, and technical jargon. This approach can be alienating and unhelpful, making it difficult for women to engage fully in their financial planning. Advisors often overlook the broader context of women’s lives, leading to dissatisfaction with the advisory experience.

Call to Action for Women of Wealth

Are you a woman of wealth who feels underserved by your current Financial Advisor? Start working with an Independent Fiduciary Advisor to create a Purpose-Centered Financial Plan that truly aligns with your values and goals.

Part Three: What Business Owners Need from Financial Advisors

What Business Owners Want in a Financial Advisor

Business owners typically seek advisors who can:

-

Offer strategic, independent fiduciary advice that aligns with their business and personal financial goals

-

Understand the complexities of running a business

-

Provide tailored solutions for succession planning, retirement, and wealth management

What Business Owners Actually Get

Many business owners find themselves dealing with advisors who prioritize sales over genuine advice. These advisors often focus on selling products with higher fees rather than providing independent, client-focused advice. The emphasis on charts and graphs, along with complex financial minutiae, can detract from addressing the broader financial planning needs of business owners.

Call to Action for Business Owners

Are you a business owner looking for a Financial Advisor who prioritizes your needs over sales targets? Start working with an Independent Fiduciary Advisor to create a Purpose-Centered Financial Plan that aligns with your business and personal financial goals.

Conclusion: A Call to Action for Financial Advisors

What Financial Planning Professionals Seek

Financial Planning Professionals are looking for a career that allows them to:

-

Genuinely help clients without the constant pressure to generate sales

-

Provide independent fiduciary advice

-

Build meaningful relationships with their clients

Call to Action for Financial Planning Professionals

Are you a Financial Planning Professional tired of the sales-driven model on Wall Street? Learn how to create a Purpose-Centered Financial Plan by enrolling in the online course: “What Matters Most for Financial Advisors.” Transform your career and help clients achieve their financial objectives in a more fulfilling way.

Purpose-Centered Financial Planning offers a path to align financial goals with personal values, providing a holistic approach that benefits clients and advisors alike. Start your journey today and experience the difference of working with an Independent Fiduciary Advisor.

Purpose-Centered Financial Planning: Aligning Your Finances with Your Life Goals

Introduction

In today’s fast-paced world, financial planning often focuses on numbers, investments, and retirement accounts. However, an emerging trend—purpose-centered financial planning—goes beyond traditional methods. It emphasizes aligning your financial decisions with your core values and life goals, ensuring that your money serves your broader purpose. This approach not only brings financial success but also enhances overall life satisfaction.

Understanding Purpose-Centered Financial Planning

Purpose-centered financial planning is about integrating your personal values and goals into your financial strategy. It involves reflecting on what truly matters to you and ensuring that your financial decisions support these priorities. This method contrasts with conventional financial planning, which typically concentrates on maximizing wealth without necessarily considering personal fulfillment.

Key Components

-

Clarifying Your Purpose: Identify what is most important to you. This could include family, career aspirations, philanthropic efforts, or personal passions.

-

Setting Meaningful Goals: Once you have clarity on your purpose, set financial goals that align with these priorities. This ensures your financial plan supports your broader life objectives.

-

Creating a Financial Blueprint: Develop a comprehensive plan that incorporates budgeting, saving, investing, and giving, all tailored to your personal values and goals.

-

Regular Review and Adjustment: Life is dynamic, and so should be your financial plan. Regularly review and adjust your plan to reflect any changes in your life circumstances or goals.

Benefits of Purpose-Centered Financial Planning

1. Enhanced Motivation and Commitment

When your financial plan is aligned with your personal values and life goals, you are more likely to stay motivated and committed. This alignment provides a clear “why” behind your financial decisions, making it easier to stick to your plan even when faced with challenges.

2. Improved Financial Decisions

Purpose-centered financial planning encourages mindful spending and investing. By reflecting on how each financial decision aligns with your overall purpose, you can avoid unnecessary expenses and make choices that truly support your goals.

3. Greater Life Satisfaction

Aligning your finances with your life goals leads to greater overall satisfaction. Knowing that your financial decisions are contributing to your broader purpose brings a sense of fulfillment and peace.

4. Positive Impact on Relationships

When your financial goals are aligned with your values, it can positively impact your relationships. Open communication about shared goals and values fosters trust and collaboration within families and partnerships.

Implementing Purpose-Centered Financial Planning

1. Reflect on Your Values and Goals

Take time to reflect on what matters most to you. Consider writing down your core values and long-term goals. This exercise helps in creating a financial plan that truly reflects your priorities.

2. Set Specific and Achievable Goals

Define clear, specific financial goals that support your broader life objectives. Ensure these goals are realistic and achievable within your financial means.

3. Develop a Comprehensive Plan

Create a detailed financial plan that includes budgeting, saving, investing, and giving. Ensure each aspect of your plan aligns with your values and goals.

4. Seek Professional Guidance

Consider working with a financial planner who understands and supports purpose-centered planning. A professional can provide valuable insights and help you develop a robust plan.

5. Regularly Review and Adjust Your Plan

Life changes, and so should your financial plan. Regularly review your plan to ensure it still aligns with your goals and make adjustments as necessary.

Conclusion

Purpose-centered financial planning is a powerful approach that integrates your financial decisions with your personal values and life goals. By focusing on what truly matters, you can achieve financial success while also enhancing your overall life satisfaction. Start your journey towards a more fulfilling financial future by reflecting on your values, setting meaningful goals, and developing a comprehensive, purpose-centered financial plan.

By embracing purpose-centered financial planning, you can ensure that your finances not only secure your future but also support a life of meaning and fulfillment.

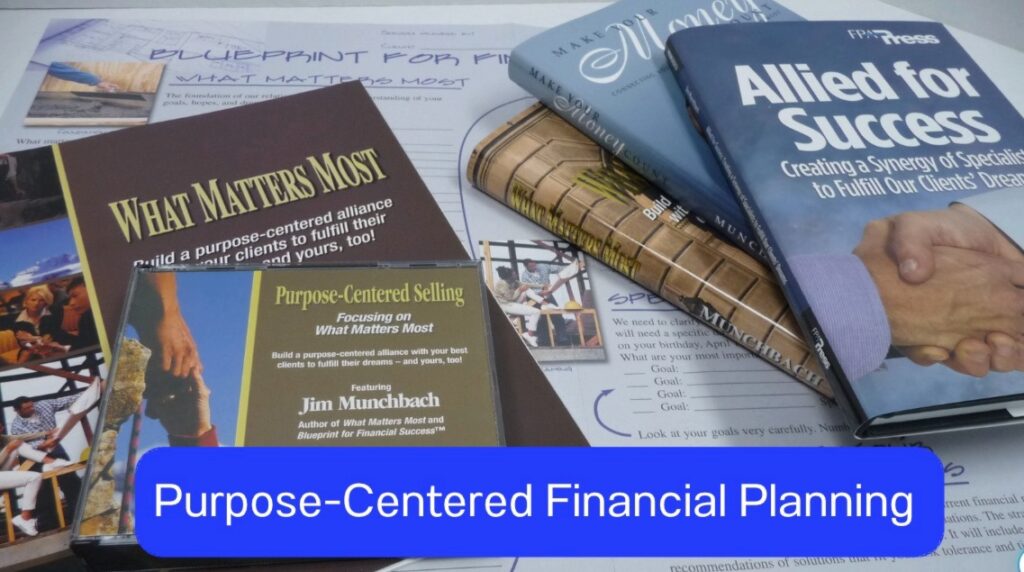

Purpose-Centered Financial Planning Book

For Women of Wealth and Business Leaders

Make Your Money Count

Special -Limited- Hard Cover Edition of Make Your Money Count by Jim Munchbach, CFP® Professional. Make Your Money Count features The Blueprint for Financial Success™ and FREE Shipping.

Buy Book Now | $24.95 | Free Shipping

Purpose-Centered Financial Planning

For Women of Wealth and Business Leaders

Purpose-Centered Financial Planning Book

For Financial Advisors and Financial Planning Professionals

What Matters Most for Financial Advisors

Special, Limited, Hard Cover Edition of What Matters Most by Jim Munchbach, CFP® Professional. What Matters Most ships with one full size copy of The Blueprint for Financial Success™. FREE Shipping.

Click Here to Buy Now, $24.95

Purpose-Centered Financial Planning

For Financial Planning Professionals

Purpose-Centered Financial Planning is focused on What Matters Most. A holistic approach that connects your financial decisons to your Vision, Values, and Purpose.

Make Your Money Count in Kindle

Make Your Money Count in Audible

What Matters Most in Kindle

What Matters Most in Audible

What Matters Most with Whisper Sync

Whisper Sync is a technology developed by Amazon that allows seamless synchronization of audiobook and eBook content across multiple devices. It ensures that users can switch between reading and listening without losing their place in the book. This feature is particularly useful for those who use both Kindle e-readers and Audible audiobooks.

Benefits of Whisper Sync

-

Seamless Transition: Users can switch between reading and listening to their book without losing their place. This allows for a flexible reading experience, accommodating different preferences and situations.

-

Multidevice Compatibility: Whisper Sync works across various devices, including Kindle e-readers, Kindle apps, and Audible apps. This ensures a consistent experience regardless of the device being used.

-

Enhanced Learning: By allowing users to listen to an audiobook while following along with the eBook, Whisper Sync can enhance comprehension and retention of the material.

-

Convenience: Users can continue their book on the go, whether they are commuting, exercising, or doing household chores, without needing to manually find their place.

-

Progress Tracking: The technology automatically syncs reading progress, bookmarks, and notes across devices, making it easier to pick up where you left off.