Financial Blueprint Assignment

-

Open your plan and take a screenshot of each section in your Blueprint

-

As you consider the goals you have on your Blueprint, write a brief summary to describe how your goals are aligned with your vision, values, and purpose.

-

Using the FREE TIC Outline, write a summary of what you learned this semester about financial planning in the context of each of these 7 elements of financial planning:

-

Financial Independence (Retirement Planning)

-

Risk Management (Insurance)

-

Estate Planning

-

Education Planning

-

Tax Planning (Strategies)

-

Investment Management

-

Cash Flow Planning (Debt Payment Strategies)

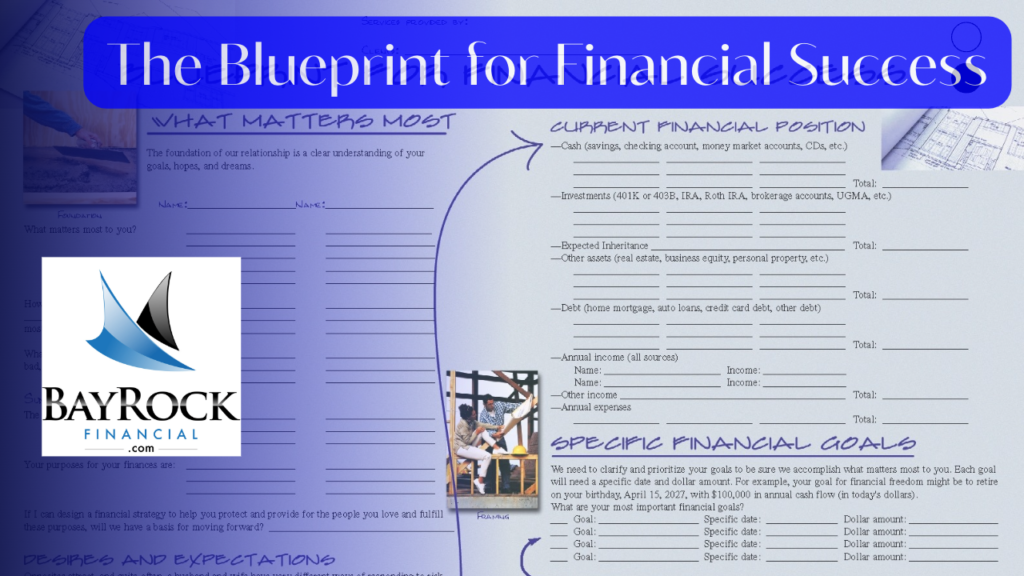

The Blueprint for Financial Success

As we prepare to wrap up this semester’s Personal Finance course at the University of Houston’s Bauer College of Business, I wanted to offer an “optional” in-depth review titled The Blueprint for Financial Success.

All students are welcome to complete The Blueprint assignment. However, for those already on track to earn an A (950 points, including up to 200 points for the Capstone and up to 200 points for Class Participation), this assignment is optional.

The Blueprint assignment gives you a chance to reflect on what you’ve learned and develop actionable steps for your financial future. Here’s an outline of the expectations and requirements for the assignment.

Step 1: Review Your Blueprint in RightCapital

Begin this assignment by logging into your RightCapital financial planning portal. Spend a few minutes reviewing your blueprint, reflecting on your progress, and gathering insights. Think about your initial financial knowledge and habits at the start of the semester and compare them to where you are now.

Reflection Notes

As you review your financial blueprint, make brief notes on the following:

• Key Learnings: What did you learn about your financial habits and behavior?

• Mindset Shifts: How has your perspective on money management changed?

• New Insights: Did you uncover any surprises or areas you weren’t previously aware of?

These notes will help you structure your article and provide the foundation for the rest of the assignment.

Step 2: Write Your Article

Write an 800 to 1,000-word article outlining your journey this semester, detailing what you learned and, most importantly, what actions you plan to take moving forward. Use the following structure to organize your thoughts:

Introduction

• Summarize your expectations at the beginning of the semester.

• Briefly mention the app you chose to track your spending, whether it was Mint, RightCapital, or another tool.

Key Learnings

• Describe what you’ve learned about budgeting, tracking expenses, and financial planning.

• Highlight specific insights related to spending habits, savings goals, or investments.

Actionable Steps

• Concrete Actions: List the actual steps you’re planning to implement as a result of this course. These could include setting up automatic savings, creating a budget, investing in a retirement fund, or eliminating unnecessary expenses.

• Personal Commitments: Identify 3-5 commitments that you’re making to yourself for the future. This section should focus on how you plan to apply your new knowledge to achieve long-term financial success.

Step 3: Show Your Work

This part of the assignment requires you to present your spending data. Your goal here is to demonstrate a clear, comprehensive record of every penny you spent this semester. This part of the assignment is split into three segments:

Segment One: Display All Your Spending Data

• If you used a spending app, it should be straightforward to export or show your data. If you tracked your expenses manually in Excel, or elsewhere, this step may take more time.

• Important Note: Failing to show your complete spending data may result in deductions, as this is a critical component of the assignment.

Segment Two: Create a Spending Graph

• Using the app or software you chose, create a graph that visually represents your spending categories.

• This could be a pie chart, bar chart, or any other visual format that best showcases how your money was allocated across categories (e.g., housing, food, entertainment, education).

• Ensure each category is clearly labeled so that your graph is easy to interpret.

Segment Three: Reflect on Your Spending

Now that you can see a visual breakdown of your spending, it’s time to reflect. In this segment, write a summary addressing the following:

• Spending Patterns: Are there areas where you consistently overspent? Did you find any unexpected patterns in your spending habits?

• Categories of Concern: Are there particular categories (like dining out, shopping, or entertainment) where you spent more than anticipated?

• Insights and Takeaways: Based on this breakdown, what would you like to change about your spending habits?

Be specific in your reflections. For instance, if you realize you spent more than expected on subscriptions or frequent shopping trips, think about ways you could reduce or manage those expenses in the future.

Final Thoughts

The Blueprint for Financial Success assignment is your chance to take stock of your financial progress, identify areas for improvement, and set clear, achievable goals for the future. Your article should reflect the personal finance lessons you’ve gained this semester and emphasize practical changes you intend to make moving forward.

By completing this assignment, you’re taking the next step in building a solid foundation for your financial future. Be thorough, be honest, and make this a meaningful reflection on how you’ll build your financial future beyond this course.

Going Deeper is an optional part of this assignment, but I will be very interested to know how you feel and what you believe about how money management impacts a person’s character.

How does a person’s vision, values, and purpose influence how they manage money.

How will your vision, values, and purpose impact your financial behavior?

Thank you for being a part of the work we did this semester in Personal Finance.

I hope some of what you learned leaves you touched, moved, and inspired to create a life you will love!

Let’s keep in touch.

Connect with Jim Munchbach on Social 🔹YouTube: https://www.youtube.com/@JimMunchbach @JimMunchbach 🔹LinkedIn: http://www.linkedin.com/in/JimMunchbach 🔹Twitter: http://twitter.com/JimMunchbach 🔹Facebook: http://www.facebook.com/JMunchbach 🔹Instagram: https://www.instagram.com/jimmunchbach 🔹JimMunchbach.com: https://jimmunchbach.com

NO ZOOM MEETING FOR NEXT WEEK! However, before completing your Capstone assignment, please be sure to review this semester’s YouTube Playlist: UHPLaylist.com