Capstone 100 Point Deduction

As we move closer to your Capstone assignment, I wanted to highlight a couple of key numbers that you need to understand. Each of these key numbers can result in a 50 point deduction in your Capstone assignment – yes, that’s 50 points each and a 100 total point deduction on your 200 point Capstone Assignment!

Ending Plan Value:

-

If you happen to see an ending value in your financial plan that is in excess of $5,000,000, you need to take a closer look and spend some time reviewing your plan.

Debt Management Result:

-

If your Debt Management Strategy is saving you $1,000,000 or more over the life of your plan, you have a problem that needs a solution!

In either of these cases (Ending value in excess of $5,000,000 or Debt Strategy Savings over $1,000,000) you will need to:

-

Make Adjustments to your plan

-

Explain what changes you needed to make in order to get these numbers back into the realm of reality.

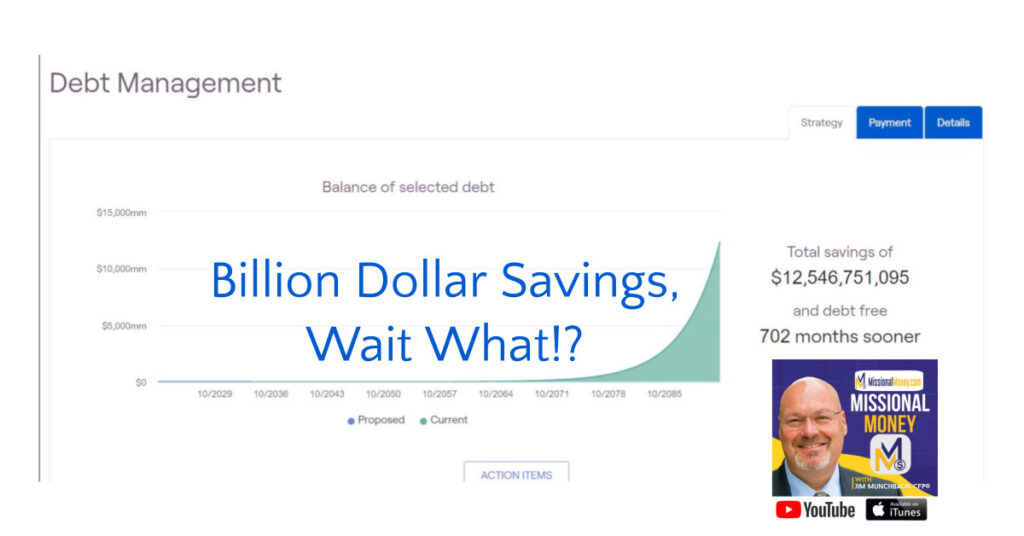

Billion Dollar Savings, Wait What!?

If you were to see this number in your plan, what would you think? What would you do? Where would you start?

Debt Management Strategy Review

Before You Apply Any Action Items, review the following elements in the Debt Management section of your plan. You’ll need to grab a “BEFORE” screenshot of these elements.

-

Strategy

-

Balance of selected debt — grab a screenshot

-

Payment

-

Proposed payments for next month — grab a screenshot

-

Details — Before (Annual works better than Monthly)

-

Remember to Grab a “Before” Screenshot of each of your Data Cards which you will compare with the “After” Screenshots.

Cost of Credit

The Credit Crush Assignment is all about understanding the cost of credit and how to apply simple strategies to eliminate debt so that you can build wealth. In this week’s assignment, you’ll enter your 3 big purchases in your BayRock financial planning portal: Home, Car, and Credit Card spending spree.

Desired Outcomes

-

Understand The Cost of Credit

-

Identify Simple Strategies for Debt Management

-

Eliminate Debt/Become 100% Debt Free

-

Build Wealth by Investing Instead of Paying Interest

Step One — Update Your Data Cards

-

Mortgage

-

Loan Type = Mortgage

-

Original Amount of Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

Loan Term — 15 or 30 Year

-

-

Car Loan

-

Loan Name = Type of Car

-

Loan Type = Car Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

-

Credit Card

-

Account Name

-

Balance (at least $10k)

-

APR — Annual % Rate (at least 10%)

-

Student Loan (optional)

-

Step Two — Take BEFORE ScreenShots of Your Data Cards

If your data cards were correctly completed from last week’s assignment, just pop those images into this week’s article. If you made updates to your data cards, be sure to create a new, updated screenshot of your data cards:

-

Mortgage

-

Car Loan

-

Credit Card

-

Student Loan (optional)

Questions June 24, 2022

Debt Strategy – No Data?

From a student… Hi, I am messaging you regarding my debt management portal on my assignment. I followed your class videos and I was wondering if I did something wrong seems like there is not any data.

Mortgage Payoff in One Month

I am attempting to complete assignment 6 and I have run into an issue with the Bayrock portal. I setup my mortgage, car payment, and credit card debt, but when I view the debt management tab, it expects me to pay the mortgage back within a month.

I even changed my numbers to match your example and I still get the same issue. Attached is a pdf showing what I am seeing in my portal.

Billion Dollar Savings, Wait What!?

If you were to see this number in your plan, what would you think? What would you do? Where would you start? Each of these key numbers (ending plan value in excess of $5,000,000 and Debt Strategy Savings of $1,000,000 or more) can result in a 50 point deduction in your Capstone assignment – yes, that’s 50 points each and a 100 total point deduction on your 200 point Capstone Assignment!