Credit Crushing Assignment

Last week, you were asked to assume you already graduated and you are earning whatever amount you hope to be earning once you’ve landed your dream job. This week, we’re going to complete the Credit Crush assignment and take a look at the upcoming Capstone Assignment.

Remember Billy and Sally?

Let’s spend a few minutes recalling their stories.

Last week – Part One: You Spent some time Researching Your Financial Future:

In order to get full credit in that assignment, you needed to research the following information:

-

Your Annual Income AFTER you graduate

-

Based on your major

-

Based on your industry

-

What is the average % of one’s income spent on Housing costs?

-

What are the basic categories needed in every household budget?

-

What are the average costs for each budget category?

-

Housing

-

Food

-

Utilities

-

Clothes

-

Taxes

-

Phone

-

Insurance

-

Maintenance

-

What are you missing?

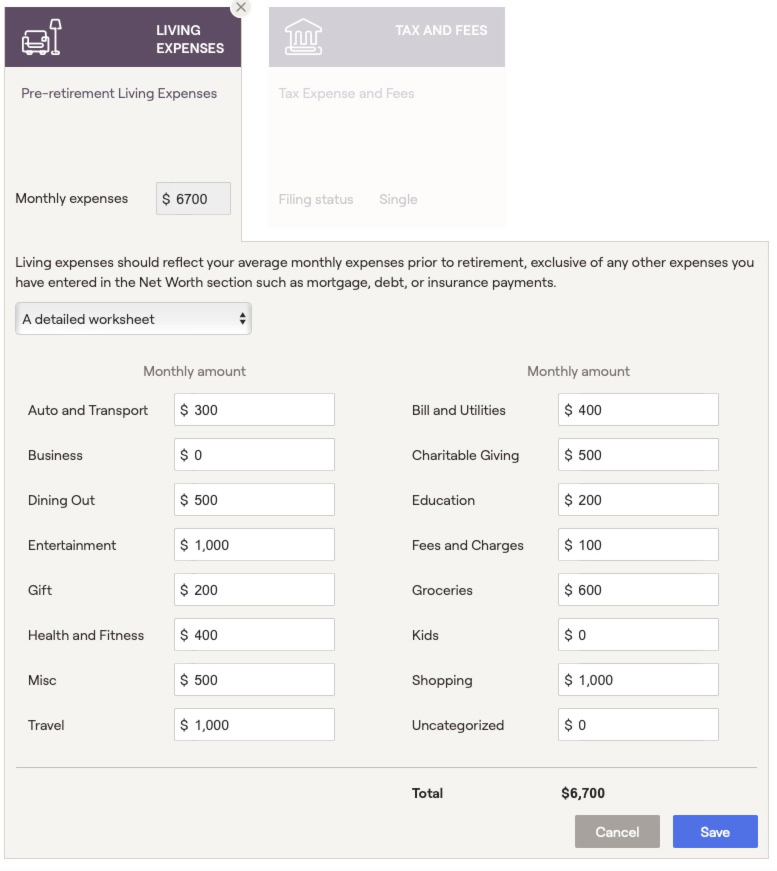

Remeber to Update your Detailed Expenses (20 Point Deduction)

-

Capstone Next Steps

Last week, you were asked to assume you already graduated and you are earning whatever amount you hope to be earning once you’ve landed your dream job.

Your Income

-

What is the average income for your major?

-

What income are you using for your plan?

-

What % of your income are you using for your mortgage in this assignment?

You Made 3 Big Purchases for This Week’s Assignment:

-

Bought your dream house

-

Bought that car you always wanted

-

Racked up some serious debt on your New Credit Card

You Took Out a Mortgage on Your New Home

-

What % of your income did you havel go toward your Mortgage?

-

You were supposed to buy the biggest house you could afford.

-

You may have bought the smallest, cheapest house you could find if you wanted fewer points on last week’s assignment.

-

You should have updated your plan with Your Mortgage Information

-

Total Purchase Price of your Home

-

How Many Years for your mortgage

-

30 years

-

15 years

-

-

You should have commented about

Your New Home, and Mortgage

-

Why did you choose your house

-

How did you come up with that mortgage payment

-

What Interest Rate are you using on your mortgage?

-

How many years is your mortgage?

You should have commented about

Your New Ride

-

Why did you choose that car?

-

How did you come up with that financing?

-

What is the interest rate on your car loan?

You should have commented about

Your Credit Card

-

What is the balance on your “pretend” credit card for this week’s assignment — I’m looking for anywhere from $5k to $25k for most students

-

How did you come up with that interest rate? (I’m looking for any where from 12% — 30%)

4 Screenshots should have been Included from Your Planning Portal

These 4 Screenshots should have been Included from Your Planning Portal

-

Income

-

Mortgage Loan

-

Car Loan

-

Credit Card Account

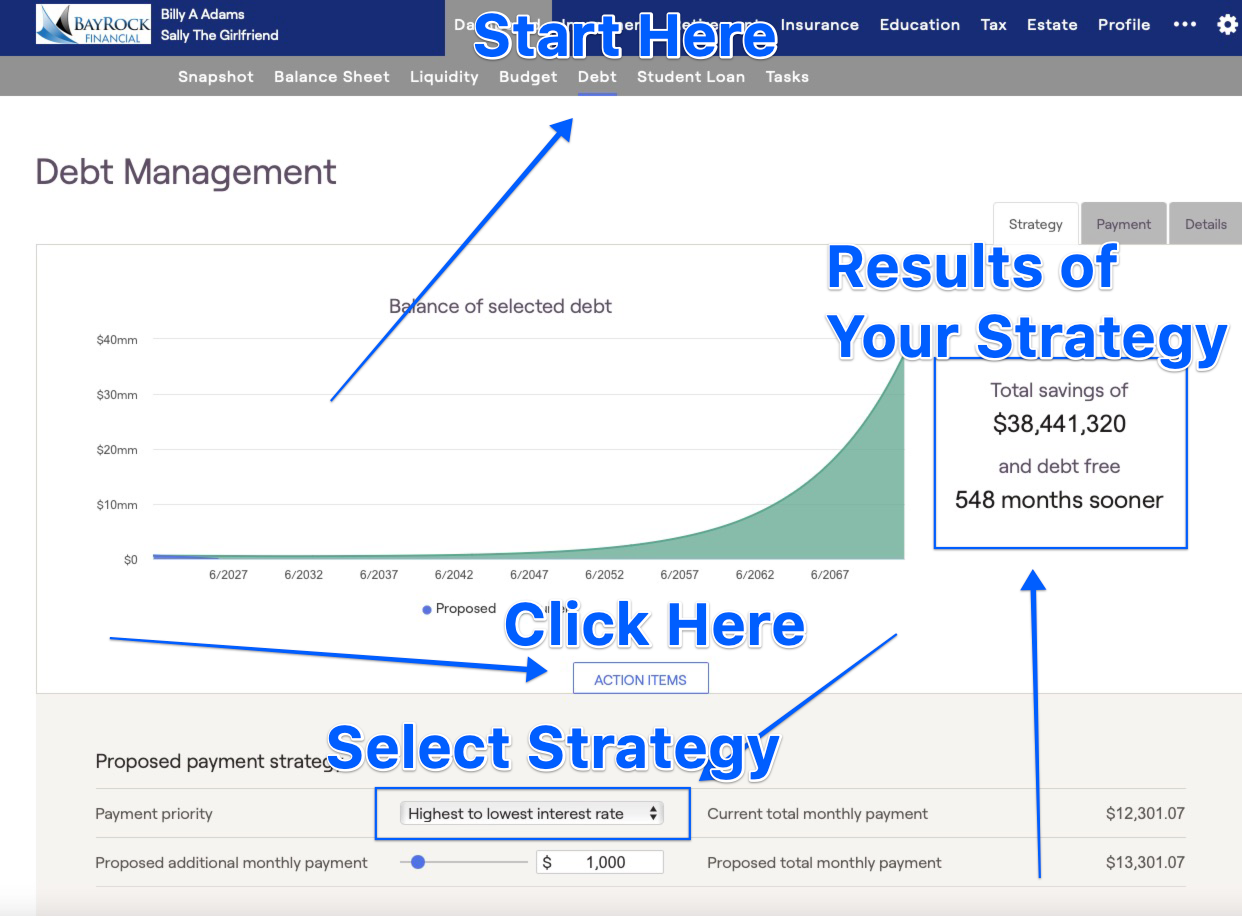

This Week’s Assignment: Credit Crush

Rewrite Your Article

I don’t care how many words, but do include a title, screen shot of week 6 quiz, and your comments addressing each element above.

Now that you’ve had more time to reflect on your life after you moved out on your own, invested in your dream house, purchased your cool ride, and racked up some credit card debt, its time to learn a few debt payment strategies to help you move toward your goal of becoming a millionaire by age 50.

Tell me what you learned this week about Debt Payment Strategies and which one you found to be most effective for you:

Same Priority for All Debt

Highest to Lowest Interest Rate

Lowest to Highest Balance

The Big Idea

The Credit Crush Assignment is all about understanding the cost of credit and how to apply simple strategies to eliminate debt so that you can build wealth. In this week’s assignment, you’ll be working with the 3 big purchases you made last week:

Your Dream Home

Your Dream Car

Your Credit Card Spending Spree

Desired Outcomes

-

Understant the 3 Simple Strategies for Debt Management

-

Eliminate Debt/Become 100% Debt Free

-

Build Wealth by Investing Instead of Paying Interest

Step One — Review Your Data Cards and Update if needed!

-

Mortgage

-

Loan Type = Mortgage

-

Original Amount of Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

Loan Term — 15 or 30 Year

-

-

Car Loan

-

Loan Name = Type of Car

-

Loan Type = Car Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

-

Credit Card

-

Account Name

-

Balance (at least $10k)

-

APR — Annual % Rate (at least 10%)

-

Student Loan (optional)

-

Step Two — Take BEFORE ScreenShots of Your Data Cards

If your data cards were correctly completed from last week’s assignment, just pop those images into this week’s article. If you made updates to your data cards, be sure to create a new, updated screenshot of your data cards:

-

Mortgage

-

Car Loan

-

Credit Card

-

Student Loan (optional)

Step Three Review Debt Management

Before You Apply Any Action Items, review the following elements in the Debt Management section of your plan. You’ll need to grab a “BEFORE” screenshot of these elements.

-

Strategy

-

Balance of selected debt — grab a screenshot

-

Payment

-

Proposed payments for next month — grab a screenshot

-

Details — Before (Annual works better than Monthly)

-

Remember to Grab a “Before” Screenshot of each of your Data Cards which you will compare with the “After” Screenshots.

BEFORE

AFTER – This is the most important Screenshot

Mortgage

Don’t forget — grab a screenshot!

Car Loan

Don’t forget — grab a screenshot!

Credit Card

Don’t forget — grab a screenshot!

Student Loan (Optional)

Don’t forget — grab a screenshot!

Step Four — Review Action Items

-

Proposed payment strategy

-

Current total monthly payment

-

Proposed total monthly payment

These are the same because you have not yet applied any payment strategies.

Payment Priority Options

-

Same Priority for All Debt

-

Highest to Lowest Interest Rate

-

Lowest to Highest Balance

Step Five — Time to Crush Your Credit!

-

Change Payment Priority

Select the best strategy for your plan and explain why you chose it and provide a brief discussion comparing each of the above payment priority options.

Compare Before and After

-

Mortgage

-

Don’t forget — grab an AFTER screenshot!

-

-

Car Loan

-

Don’t forget — grab an AFTER screenshot!

-

-

Credit Card

-

Don’t forget — grab an AFTER screenshot!

-

-

Student Loan (Optional)

-

Don’t forget — grab an AFTER screenshot!

-

Step Six — Tell Me What You See

-

Mortgage

-

Car Loan

-

Credit Card

-

Student Loan (optional)

-

Overall Results

-

Total savings of How Much $$$

-

Debt Free in ?? Months Sooner

Final Steps

— Add Assignment 6 Quiz Screenshot

— Add Assignment 6 Class Collaboration [Comment] Screenshots:

In addition to the class collaboration item listed below, be sure to include a screenshot for this week’s class collaboration component(s) as outlined in this week’s Zoom Meeting.

Post your brief comments about what you learned this week about:

Payment Priority Options

-

Same Priority for All Debt

-

Highest to Lowest Interest Rate

-

Lowest to Highest Balance

You can post in Money Study Group, on FB, or in YouTube — just grab a screenshot and include in your assignment.

Submit Only One PDF File to Canvas

Capstone Assignment Preview

3 Goals for Your Capstone Assignment

3 Goals for Your Capstone Assignment

-

Earn 200 of the 950 Points Needed for an “A”

-

Define and Describe the Essential Elements of a Financial Plan

-

Create a Capstone Report to Illustrate Your Financial Plan

The Capstone Report

The Essential Elements

-

Watch The Capstone Assignment Video in Money Study Group

-

Review the Course Material Posted in Money Study Group

-

Create Your Final Report and Upload in BB

-

For each of the Essential Elements listed below, include the following:

— Include Screen Shots

— Tell me What Changes You Made, if any, Before and After each element.

— Address the specific questions listed next to each element.

Balance Sheet

-

Assets

-

Liabilities

-

Net Worth

Budget

-

Be sure to include your detailed budget in the screenshot.

-

If you did not link your credit/debit card, explain why and be sure you’ve added the detailed budget items manually (25 points).

Debt and Debt Strategy

-

Refer back to your Credit Crush Assignment if you need a refresher.

-

Describe your Debt Payment Strategy.

-

Tell me how you plan to use what you learned about Credit Cards (and debt in general) after you graduate.

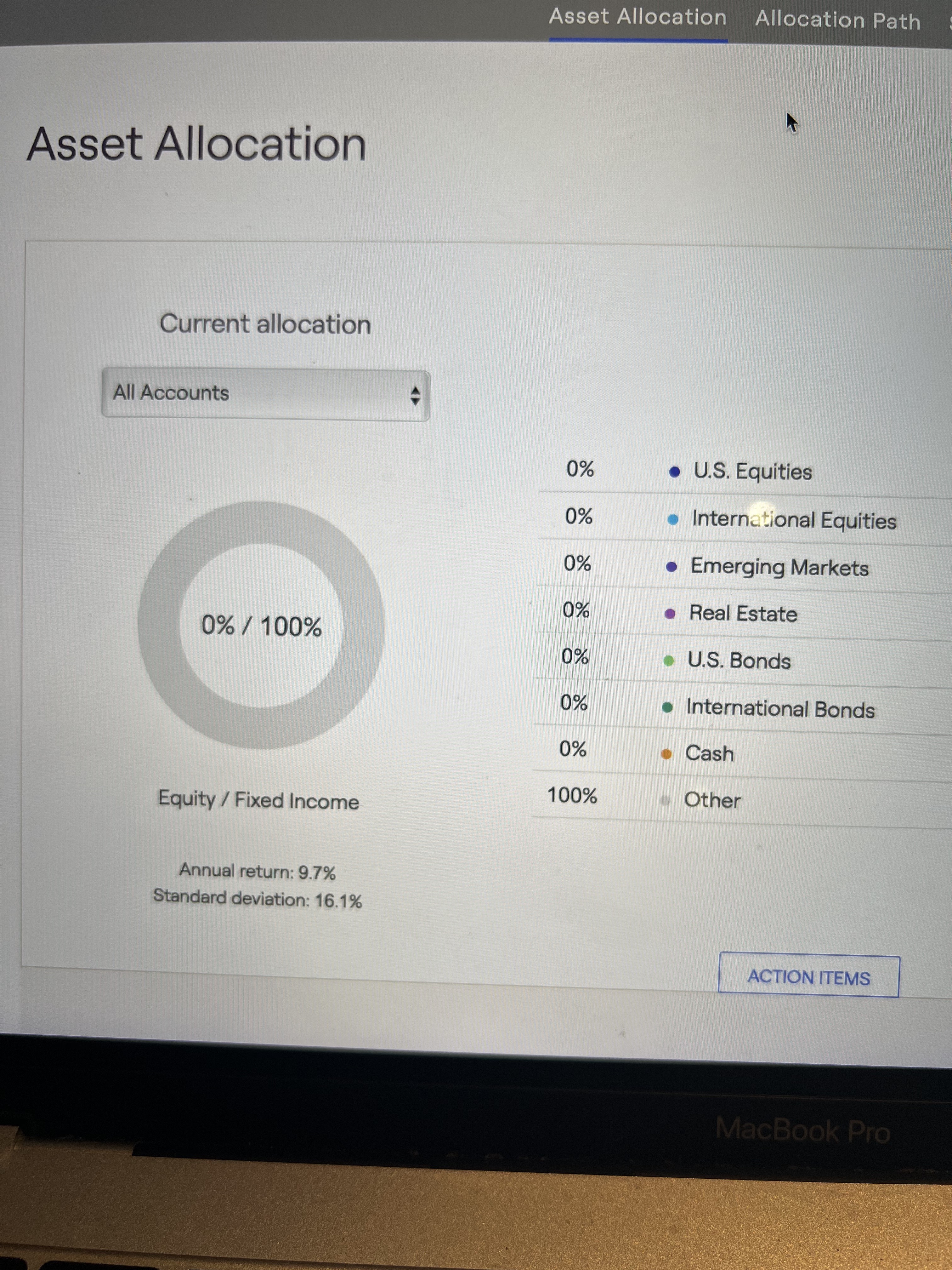

Asset Allocation

-

Tell me what you learned about Asset Allocation in this course.

-

How did you apply this new information in your financial plan?

-

What Asset Allocation will you use in your 401k after you graduate?

-

How much did Asset Allocation change your Probability of Success?

Tax Allocation

-

In general, what did you learn this semester about Tax Allocation? — What is Tax Allocation?

-

How will you use what you learned about Tax Allocation after you graduate?

-

Will you fund a Roth IRA?

Holdings

-

Discuss the actual holdings you selected for your portfolio.

-

Explain the difference between a holding and an asset class.

-

Explain the difference between a holding and Type of Account.

-

Explain the difference between a holding and Type of Investment.

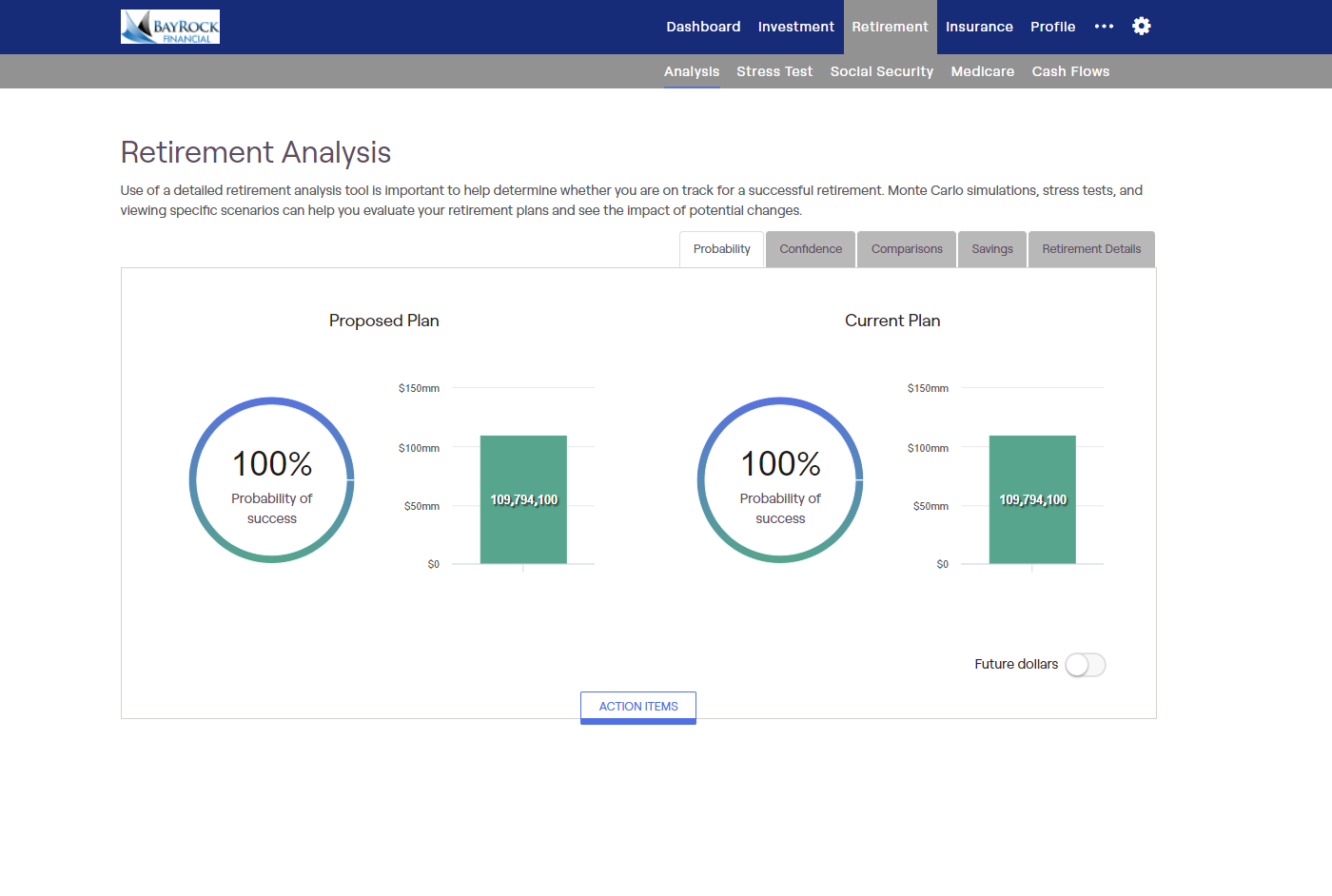

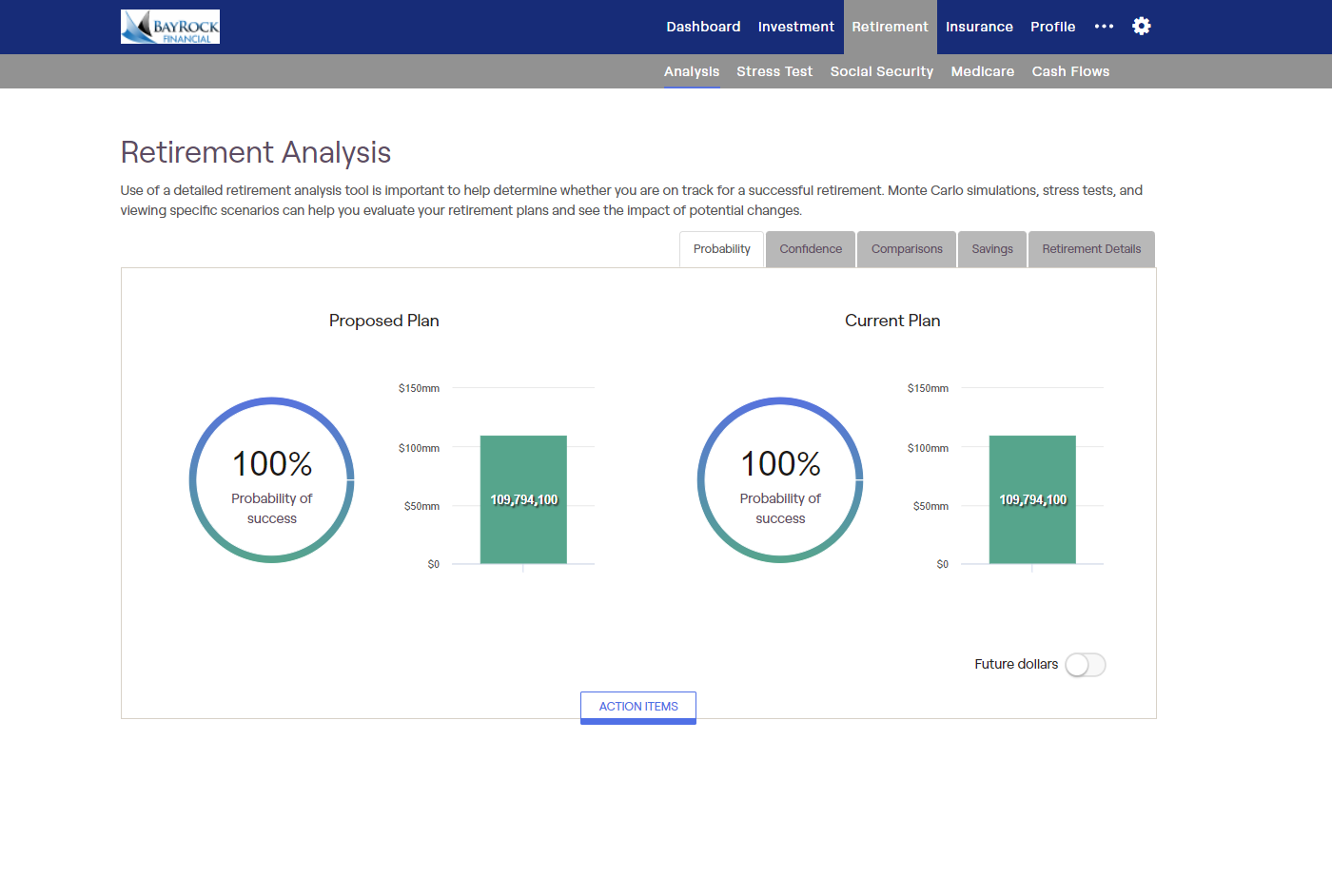

Retirement Analysis

-

Which elements in a financial plan can “move the needle” the most in terms of Probability of Success?

-

How much money is left at the end of your plan?

-

If (after making changes to your plan) you have an excessive amount of money left at the end of your plan, be sure to explain why you have so much excess.

Probability of Success too Low or Excessive Money Left at End of Plan

-

Unreasonable Income?

-

Too Much/Too Little Savings?

-

Too Low or Too High Expenses?

-

Pre-Retirement

-

Post-Retirement

Be sure to add 10 years to your age to help offset the additional money in your accounts.

-

Cash Flow Summary Screen

-

In reviewing your Cash Flow Summary Screen, was there anything you saw that would raise a question when I review it?

-

Spend a few minutes trying to figure out how to answer the question I’m going to ask about your Cash Flow Summary.

-

If it all looks great, move on to the next screen.

Net Worth

-

In reviewing your Net Worth Summary Screen, was there anything you saw that would raise a question when I review it?

-

Spend a few minutes trying to figure out how to answer the question I’m going to ask about your Net WorthSummary.

-

If it all looks great, move on to the next screen.

Invested Assets

-

In reviewing your Invested Assets Summary Screen, was there anything you saw that would raise a question when I review it?

-

Spend a few minutes trying to figure out how to answer the question I’m going to ask about your Invested Assets Summary.

-

If it all looks great, move on to the next screen.

Accounts

-

In reviewing your Accounts Summary Screen, was there anything you saw that would raise a question when I review it?

-

Spend a few minutes trying to figure out how to answer the question I’m going to ask about your Accounts Summary.

-

If it all looks great, move on to the next screen.

Insurance

In each of the insurance categories listed below, briefly explain…

-

What insurance did you add to your plan and why?

-

After you graduate, what insurance should you add to your plan and why?

Life

Disability

Property and Casualty

Long-Term Care

Profile Review

-

Take a few minutes to review your overall plan profile and comment as outlined below for each screen.

-

Don’t worry, you won’t be graded on your comments — but each screen needs to be included in your Capstone Report!!

Net Worth

What accounts, loans, or insurance would you add to your plan in real life? Remember, this is an important part of your planning portal.

Goals

-

Do you feel like you have a good set of goals?

-

What goals would you add in real life after you graduate?

-

What goals did you want to include if money were no object?

Income

-

Did you include income from your “Dream Job”?

-

If your income is too high or too low, please tell me why.

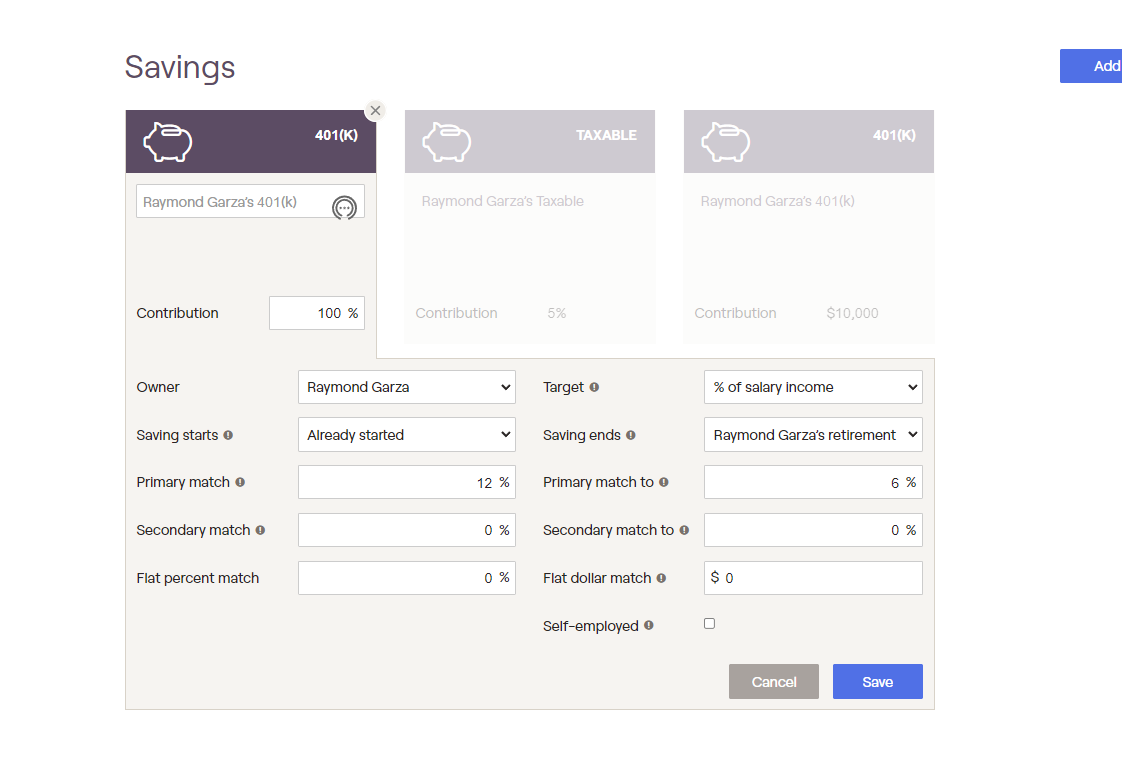

Savings

-

What do you think about your overall savings plan?

-

Is it realistic?

-

What might you change in real life once you start working full-time?

Expenses

-

What do you think about the expenses listed in your plan?

-

Are they realistic?

-

What might you change in your budget in real life once you start working full- time?

Family

-

Tell me about your family in the future.

-

Would it be helpful to have a financial plan in real life once you start your family?

-

Discuss the challenges and opportunities that come with having a financial plan.

-

Final Element: Capstone (Class Collaboration Element)

How much money is left in your plan?

-

Be sure to review: Probability of Success too Low or Excessive Money Left at End of Plan

-

Do you have Excessive Money in your plan?

-

You should have somewhere between $100,000 and $3,000,000 at the end of your plan, depending on your salary, savings, and goals

-

If you have over $5,000,000 you need to take a closer look at your plan: Expenses, Income, Investments

-

50 POINT Deduction if you don’t explain Excess Money in your plan.

-

Class Collaboration Screenshot is needed!

-

Don’t Forget to Upload ONE PDF to Canvas

Capstone Q&A

Capstone Workshop – Zoom Meeting April 26, 2022

Raymond – Age Question, $109,000,000 Plus

-

I am wondering, for the capstone assignment do we change our age to our current age, or do we keep it as if I was 10 years older. Do we just start as if we were our age now?

-

I also have a question in regards to what I attached below, I am not sure as to how to use the primary match and primary match to?

-

I don’t understand why my number is so high? Is it because of my primary match and maybe my growth in my career? I know growth for me will be at about 12% in the beginning every year.

Jonathan Money Question

The area I need help on is figuring out the right amount of money I would use as after retirement expenses without limiting myself too much but at the same time, not run out of money.

Gabriel Sanchez – Mortgage Payoff

I had a question for the Capstone Workshop that you will hold tomorrow. I am worried that I will get penalized because I had set my mortgage loan for a fixed 30 year loan. However, when I apply debt payment strategies, at the very last year an unrealistic amount is being paid towards the mortgage loan, not allowing the loan to span the whole 30 years. I’d like to get a fix for this, however I have tried various things on my end and I am not sure what else could be affecting the loan.

Obi – Future Dollars?

In the retirement analysis section, are we supposed to have “Future dollars” turned on to avoid having an exorbitant amount of retirement savings? Thanks.

Ashley How to Adjust Asset Allocation

Capstone Workshop Questions

-

How do I adjust my asset allocations to better move my retirement needle?

-

how to pick and add investments into bayrock ? I only have the IRA

Hannah

I had a couple of questions regarding my retirement probability after adding in the tax advantage accounts for this week’s assignment:

-

I had inputted a 401k account during a pervious assignment. Was this a mistake and/or should this be removed?

-

My retirement probability is 97% with over $25,000,000. This seems to be way too high, and I can’t figure out why? Is it because of the other 401k account?

Yong-Er See 3%

For my class collaboration I would like to ask about my probability cards in Bayrock. My proposed plan in Bayrock currently has a 3% probability of success, but the current plan has 0% of success even though I have inputted all the new information. I am not sure if this should be correct, since the example picture for the “After Probability” has some percentages in the current plan. I will attach what I see below for more insight.

How Can I Be Sure My Numbers are Good

Good Morning,

Regarding the capstone project, so far I have gotten full points for my work, but how do I know that my data cards are displaying the correct range of numbers to receive full points for the project?

Tax Allocation – 100% Taxable

Greetings Professor!

I am emailing you because I am a little confused about my portfolio on BayRock. Attached is a screenshot of my tax allocation.

I started off with $365,000 in taxable assets and I’m not sure if this is supposed to be like this. Am I on the right track or is this completely wrong?

Thanks,

Linda

Sue

Hi Professor,

Please see the questions below for the Capstone Workshop:

Probability – total earnings

-

How do we know if our total earnings at the end of our plan are reasonable? For example, my total earnings are approximately 5 million before tax allocation and 10 million after adding $50,000 to three investment accounts.

Expenses:

-

How do we know if our pre-retirement and post-retirement expenses are reasonable?

-

Should we refrain from adding monthly mortgage and other debt payments to our expense data cards?

Future Salary:

-

I have based my Bayrock plan on the salary I will earn after 5+ years of working, rather than my salary straight out of college. I did this because I do not plan on purchasing a home or car until I reach a certain income. Is it okay if I keep my Bayrock plan the way it is, or do I need to adjust everything based on my income immediately after graduating?

Sam

Hi, Professor Munchbach

This is Sam in your 11:30 class. About this week’s class collaboration, my question is that since 401(k) is contributed with pre-tax money and pays tax when withdrawing, is the tax rate the same for different people after they are retired? And according to the video, it is best to choose 401(k) if the investor is already making a lot of money and expecting to retire in a lower tax bracket, does it mean the investor will have to get to a lower position in the company or get a lower-income job to get into the lower tax bracket?

Thank you and late happy birthday!

Sam

George

Needle Not Move Good evening professor,

My name is George, and my student ID is 1918361, and I am in your Personal Finance class from 10-11:30 am on Tuesday. I have question regarding the portal planning.

I have trying so many ways to try to move the Probability Needles, but the needles was never move, and I am not sure if I miss something or if I did not do it correctly. This is my question regarding for week 11 class collaboration.

Have a good weekend

Thank you.

George

Skylar

Hello Professor, I just submitted this weeks assignment and now i do have some questions for capstone. Is my 401k supposed to be under my investments tab? Also my probability of success is still 100% and i’m not sure as to why. I keep playing with it but nothing is changing. Also for my asset allocations my annual return is 9.7% but standard deviation is 16.1%

i’m uncertain on how to get the percentages to move

Keep Your Age 10 Years Plus, yes

For the Capstone project, I would like to confirm whether we are supposed to keep the same settings and changes we made to our financial plan on Bayrock for previous assignments? For example, do we keep our birthday as 10 years older than we actually are for the Capstone as well, or is this just for the Week 10 Assignment?

Due Dates for BB Assignments

Hi Professor,

I just had a question about the last few assignments for the class.

The last due dates for the last 3 assignments are April 26th, May 10th, and May 24th. Are all these assignments really going to be assigned to us? Are the due dates for these assignments going to be changed?

These questions especially apply to the last assignment due May 24th, since Instructor Grades are due May 16th.

Please get back to me as soon as you can.

Thank You,

Patrick

Great question, Patrick. I’ll be updating the assignment due dates so that we can get the grades submitted to UH by May 16. I’ll discuss/announce this when I do the Capstone Workshop.

Best,

JRM April 22, 2022 at 11:52 AM

Jose

The only issue I’m having in the capstone assignment is that in the retirement tab in the probability section, For some reason the only way my probability of success goes up is if i change my age to 91. I’m not sure what I’m doing wrong. I have done step by step what you have provided us to be successful on the capstone. Please check my account and give me some guidelines on what I’m doing wrong to correct these issues. That is the only issue I’m having.

For this class, I’m having a blast learning new things every week. The assignment is pretty straightforward i would recommend other students to take this course. I have only good things to say about this course “personal finance”.

Capstone 100 Point Deduction

As we move closer to your Capstone assignment, I wanted to highlight a couple of key numbers that you need to understand. Each of these key numbers can result in a 50 point deduction in your Capstone assignment – yes, that’s 50 points each!

Ending Plan Value:

-

If you happen to see an ending value in your financial plan that is in excess of $5,000,000, you need to take a closer look and spend some time reviewing your plan.

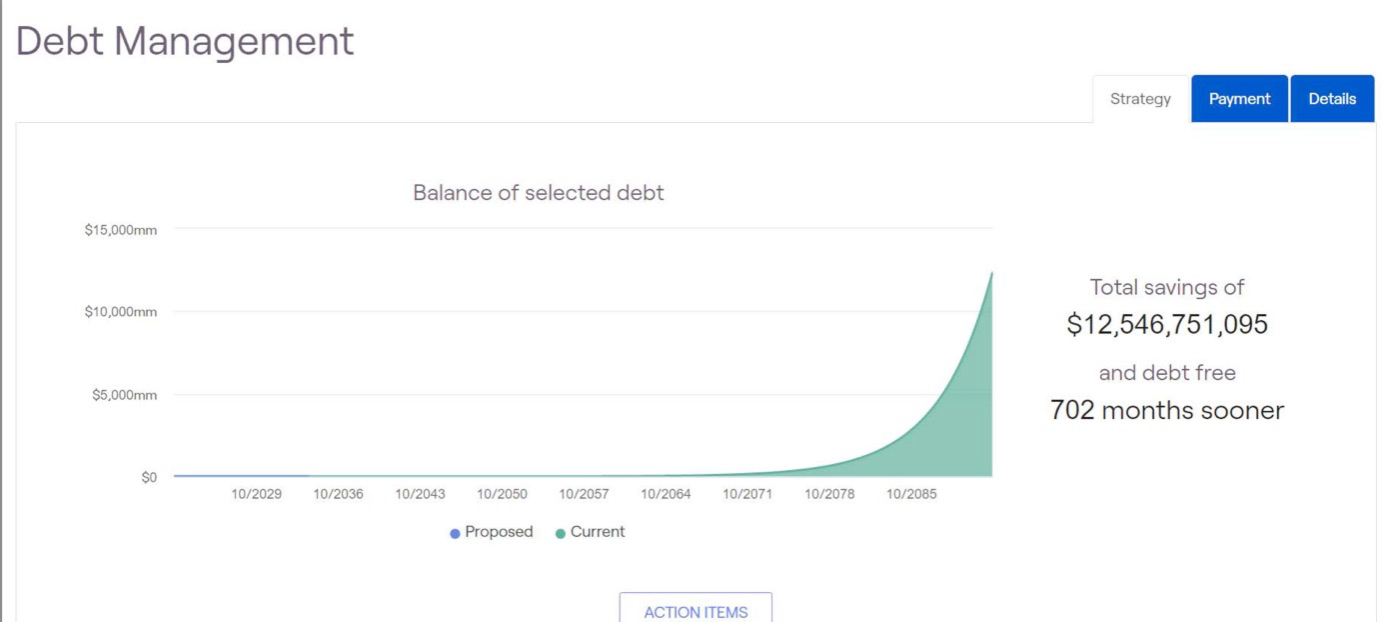

Debt Management Result:

-

If your Debt Management Strategy is saving you $1,000,000 or more over the life of your plan, you have a problem that needs a solution!

In either of these cases (Ending value in excess of $5,000,000 or Debt Strategy Savings over $1,000,000) you will need to:

-

Make Adjustments to your plan

-

Explain what changes you needed to make in order to get these numbers back into the realm of reality.

Billion Dollar Savings, Wait What!?

If you were to see this number in your plan, what would you think? What would you do? Where would you start?

Debt Management Strategy Review

Before You Apply Any Action Items, review the following elements in the Debt Management section of your plan. You’ll need to grab a “BEFORE” screenshot of these elements.

-

Strategy

-

Balance of selected debt — grab a screenshot

-

Payment

-

Proposed payments for next month — grab a screenshot

-

Details — Before (Annual works better than Monthly)

-

Remember to Grab a “Before” Screenshot of each of your Data Cards which you will compare with the “After” Screenshots.

Cost of Credit

The Credit Crush Assignment is all about understanding the cost of credit and how to apply simple strategies to eliminate debt so that you can build wealth. In this week’s assignment, you’ll enter your 3 big purchases in your BayRock financial planning portal: Home, Car, and Credit Card spending spree.

Desired Outcomes

-

Understand The Cost of Credit

-

Identify Simple Strategies for Debt Management

-

Eliminate Debt/Become 100% Debt Free

-

Build Wealth by Investing Instead of Paying Interest

Step One — Update Your Data Cards

-

Mortgage

-

Loan Type = Mortgage

-

Original Amount of Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

Loan Term — 15 or 30 Year

-

-

Car Loan

-

Loan Name = Type of Car

-

Loan Type = Car Loan

-

Monthly Payment

-

Balance

-

Interest Rate

-

-

Credit Card

-

Account Name

-

Balance (at least $10k)

-

APR — Annual % Rate (at least 10%)

-

Student Loan (optional)

-

Step Two — Take BEFORE ScreenShots of Your Data Cards

If your data cards were correctly completed from last week’s assignment, just pop those images into this week’s article. If you made updates to your data cards, be sure to create a new, updated screenshot of your data cards:

-

Mortgage

-

Car Loan

-

Credit Card

-

Student Loan (optional)

Questions June 24, 2022

Debt Strategy – No Data?

From a student… Hi, I am messaging you regarding my debt management portal on my assignment. I followed your class videos and I was wondering if I did something wrong seems like there is not any data.

Mortgage Payoff in One Month

I am attempting to complete assignment 6 and I have run into an issue with the Bayrock portal. I setup my mortgage, car payment, and credit card debt, but when I view the debt management tab, it expects me to pay the mortgage back within a month.

I even changed my numbers to match your example and I still get the same issue. Attached is a pdf showing what I am seeing in my portal.

Billion Dollar Savings, Wait What!?

If you were to see this number in your plan, what would you think? What would you do? Where would you start?