Tax Advantaged Investing Strategies

Part One – Article

Asset Allocation and Tax Allocation Review

Roth IRA vs 401k or Traditional (deductible) IRA

Watch the two videos listed below and do your own search to find additional resources to learn more about these types of accounts:

Roth IRA

Traditional (Tax Deductible) IRA

401K Retirement Account

For students at the Bauer College of Business at University of Houston:

Write an article 300 – 500 words,

Format the article as you would for other video summary assignments,

Include at least three source links in your article to receive full credit.

One of your links needs to be a YouTube.com link

Compare and contrast the Roth IRA vs the Traditional (Tax Deductible) IRA with respect to the following:

-

Who is eligible?

-

What are the Tax Advantages?

-

How much can a person contribute on an annual basis?

-

When can investors withdraw funds?

-

Tax Penalties

-

Distribution Requirements

-

Any Exceptions related to penalties and withdrawals

Becoming a Millionaire: Roth IRA vs 401K (What makes the MOST PROFIT)

Jim Cramer: Roth Or Traditional Account?

Part Two – BayRock Plan Updates

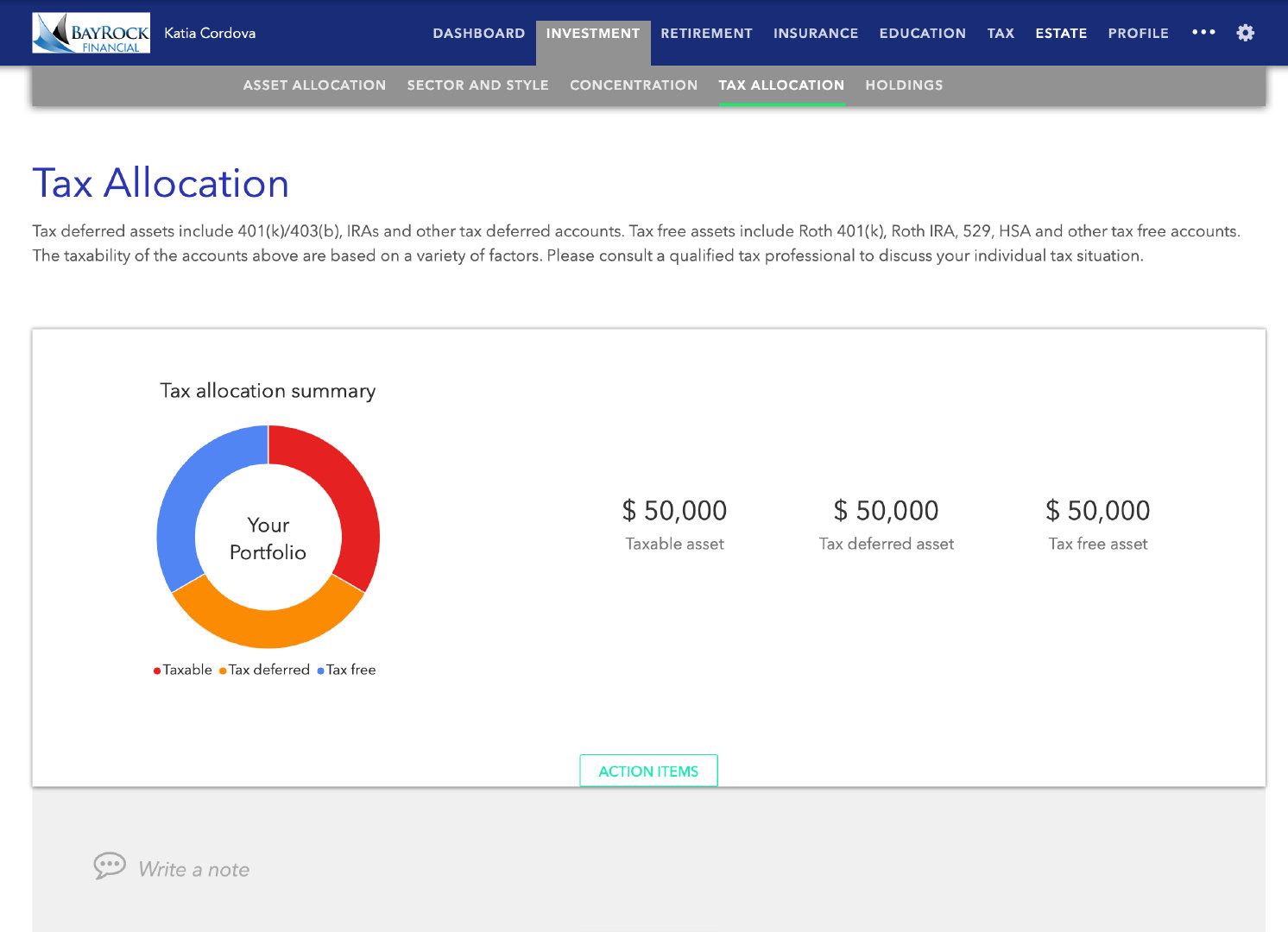

Tax Allocation

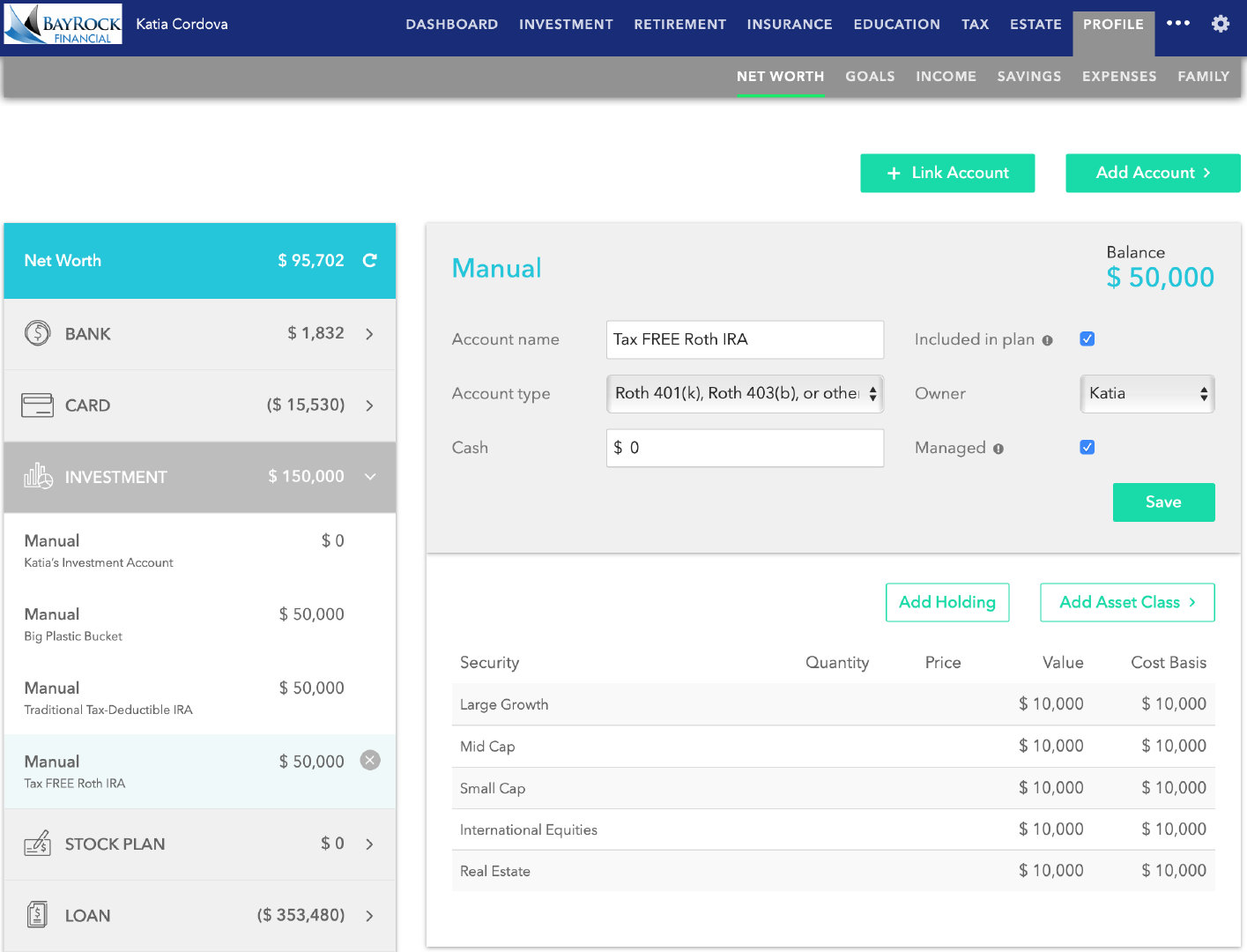

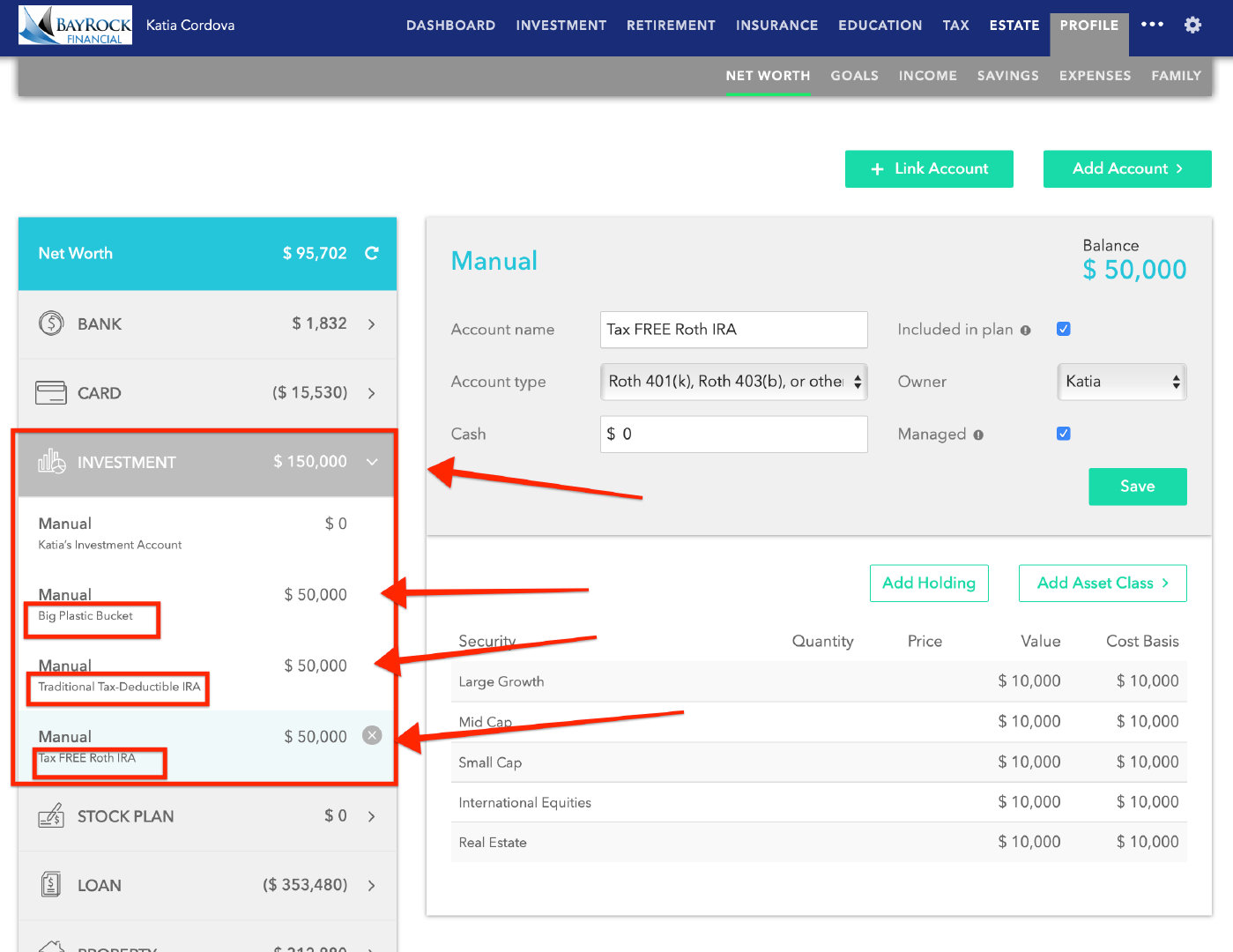

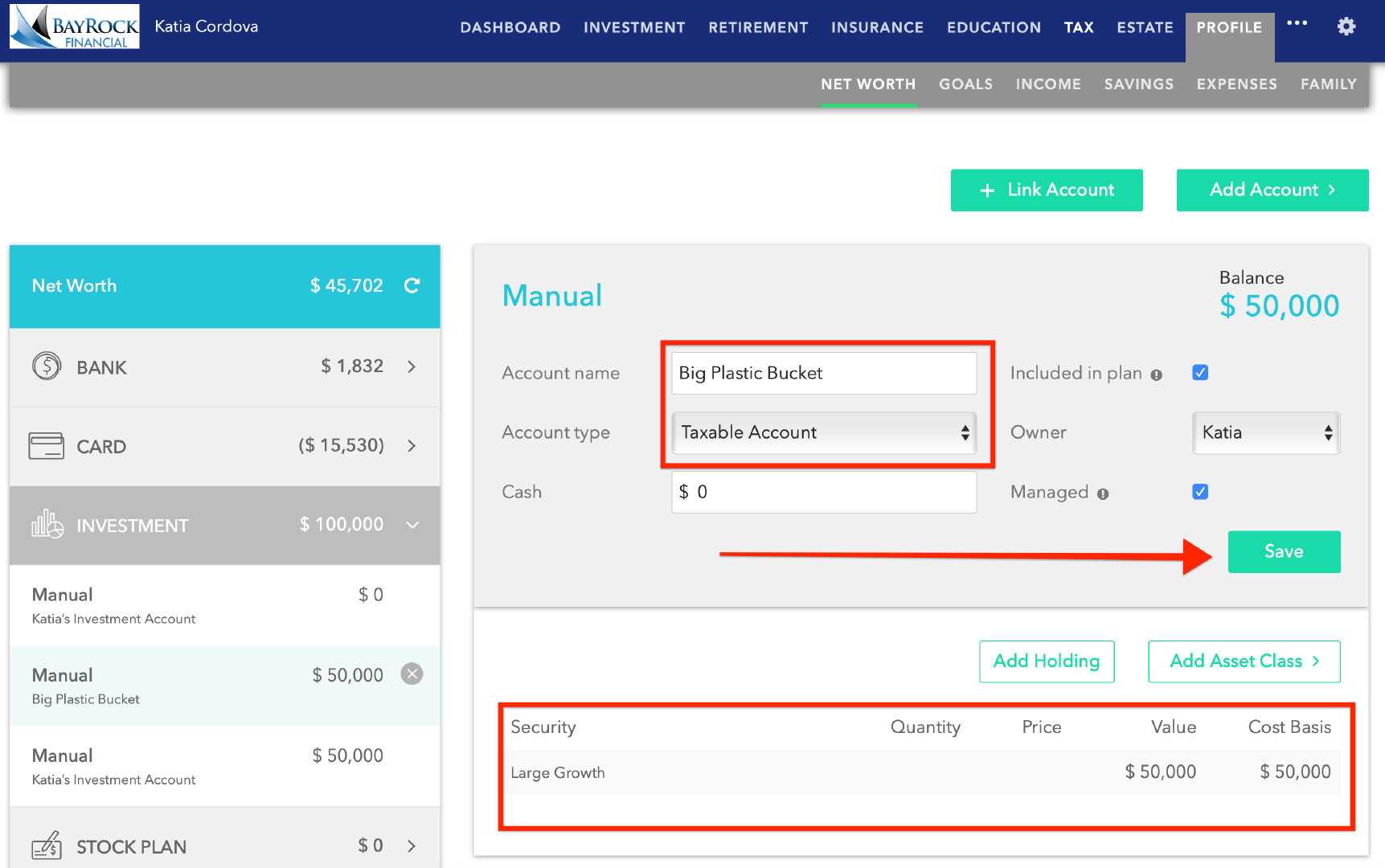

In part two of this Asset Allocation and Tax Allocation Review, you’re going apply what you learned about Tax Allocation. You will first need to update your planning portal with an extra $150,000 in 3 different investment accounts. You can delete these accounts after you complete your Capstone Assignment. Use your own Asset Allocation as you create your investment accounts. And tell me what you learned as you pay close attention to how your choices impact your financial plan.

Asset Allocation and Tax Allocation Review Screenshots”

-

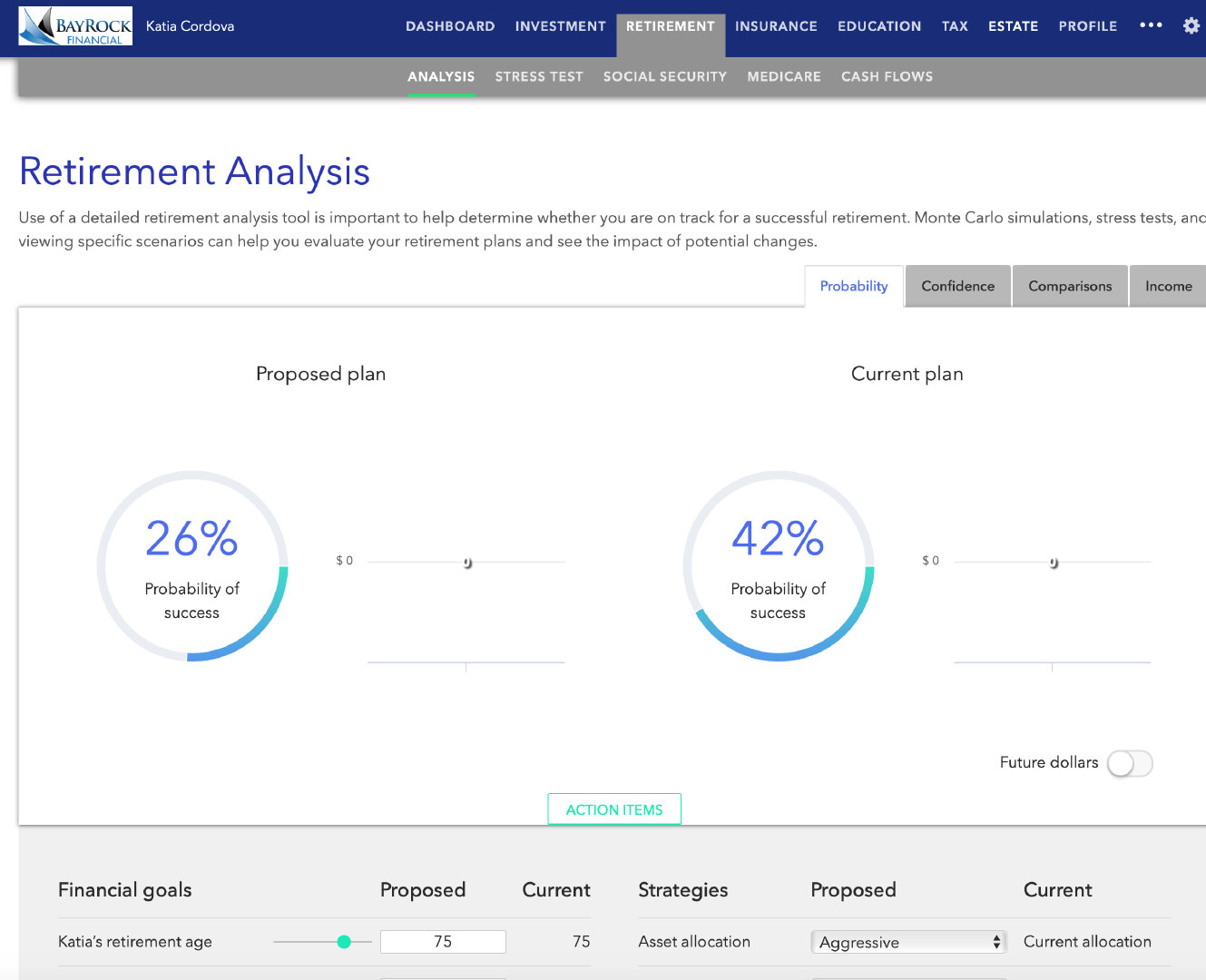

Before Probability

-

Before Asset Allocation

-

Before Tax Allocation

-

Investment: Big Blue Bucket — $50k

-

Investment: Tax Deductible IRA — $50k

-

Investment: Tax Free Roth IRA — $50k

-

Investment Account Summary

-

After — Asset Allocation

-

After — Probability

-

After — Tax Allocation

Asset Allocation and Tax Allocation Review Before Screenshots

Asset Allocation and Tax Allocation Review Probablity

Asset Allocation

Tax Allocation

Asset Allocation and Tax Allocation Review

Add 3 Investment Accounts

Taxable Account — $50,000

Big Blue Plastic Bucket

Tax Deferred

Tax Deductible IRA — $50,000

Big Brown Bucket (401K)

Asset Allocation and Tax Allocation Review Tax Free Accounts

Roth IRA — $50,000

Small Gold Bucket

Asset Allocation and Tax Allocation Review Investments

Investment Account Summary

Asset Allocation and Tax Allocation Review After Screenshots

Asset Allocation

Asset Allocation and Tax Allocation Review Probability

Tax Allocation

Asset Allocation and Tax Allocation Review Homework

For students at the Bauer College of Business at University of Houston who are enrolled in Money Study Group:

Include Session 11 Quiz (Screenshot)

Weekly Zoom Meeting

This Week’s Zoom Meeting includes a secret screenshot that is part of this week’s class collaboration.

In addition to the other topics that are open for you to discuss in this week’s assignment, be sure to include this week’s Secret Screenshot! If you’re missing this week’s Secret Screenshot, you should expect a Ten Point Deduction.

As always, this week’s Zoom Meeting is posted to this semester’s YouTube Playlist.

Include One PDF File with all Screenshots Please.

Video Description on YouTube

Tax Advantaged Investing Strategies

https://missionalmoney.com/assignment/tax-advantaged-investing-strategies/

Part One – Article

Asset Allocation and Tax Allocation Review

Roth IRA vs 401k or Traditional (deductible) IRA

Watch the two videos listed below and do your own search to find additional resources to learn more about these types of accounts:

-

Roth IRA

-

Traditional (Tax Deductible) IRA

-

401K Retirement Account

For students at the Bauer College of Business at University of Houston:

Write an article 300 – 500 words,

Format the article as you would for other video summary assignments,

-

Include at least three source links in your article to receive full credit.

-

One of your links needs to be a YouTube.com link

-

Include Outline of Zoom Meeting (see below for more details)

Compare and contrast the Roth IRA vs the Traditional (Tax Deductible) IRA with respect to the following:

-

Who is eligible?

-

What are the Tax Advantages?

-

How much can a person contribute on an annual basis?

-

When can investors withdraw funds?

-

Tax Penalties

-

Distribution Requirements

-

Any Exceptions related to penalties and withdrawals

Summary

Introduction and apologies @ 0:00

Jim apologized for technical difficulties before reviewing key financial planning concepts and introducing the lesson on tax-advantaged investing and tax allocation.

Review of financial planning concepts @ 0:35

Jim reviewed the three laws of personal finance – spending and saving, tax-advantaged investing, and purpose and commitment. He also discussed the free tick framework and blueprint for financial success approach to planning.

Investment strategies and asset classes @ 3:00

Jim reviewed the four main investment strategies – asset allocation, diversification, dollar cost averaging, and portfolio rebalancing. He emphasized understanding asset classes to apply these strategies effectively.

Tax-advantaged accounts and tax allocation @ 22:00

Jim discussed the key “buckets” of taxable, tax-deferred, and tax-free accounts. He stressed the importance of allocating a minimum of $50,000 to each account type in the financial plan for the tax allocation assignment.

Conclusion and next steps @ 48:20

Jim summarized the lesson and secret class collaboration on tax allocation. He encouraged students to update their financial plans and ask questions as needed to complete the assignment successfully.