The Blueprint for Financial Success Assignment

“Unless commitment is made, there are only promises and hopes . . . but no plans.” —Peter Drucker

Rafe and Liz had been dreaming about building a new house since they got married fifteen years ago. When they went on vacations, they often drove through nice neighborhoods in distant cities to get more ideas. They devoured magazines for design concepts for houses and landscaping, and they talked endlessly about the kind of house they wanted to build. Thinking about their dream house was almost a game to them, and they enjoyed it.

During those years, Rafe was promoted several times, and each time, they got a little closer to the point of saying “yes” to build their home. Then, Liz received an inheritance from her grandmother’s estate, just enough to give them a sizable down payment. That did it. They were ready!

They kicked their planning into high gear. Instead of dreams, they now started making plans. Suddenly, they realized they had to make some decisions—some hard decisions—about what’s most important to them.

They quickly understood that those years of dreaming about their ideal home would have to be tempered by the reality that they couldn’t do everything they’d ever wanted to do. After all, people worth millions of dollars owned many of the houses they’d seen. Rafe and Liz had significant resources, but not millions.

Liz loved to entertain, so having a nice dining room was important to her.

Their daughter was in middle school, and their son was in the fourth grade. Rafe enjoyed playing soccer and baseball with his son, so he wanted a big backyard.

They both wanted their bedroom to be a long way from the kids’ rooms. They looked at plans for a 4000 square foot house that had a large dining room, but if they built their house that large, they could only afford a small lot that wasn’t in the school district where they wanted to live.

As the days went by, they had to talk through their hopes and dreams, and they both had to be willing to compromise. After weeks of long and occasionally intense conversations, they realized that one of their biggest priorities was a game room.

Their children would be in middle school and high school in the coming years, and they wanted a place where they could bring their friends to hang out.

The process of planning may have dampened some of their dreams, but it helped Rafe and Liz clarify their real desires for their family.

They hired a builder who had some great house plans, and they were able to tell him exactly what they could afford and what they wanted. Soon, they decided on a plan, and they picked a neighborhood that wasn’t what they had dreamed about, but it fit their newly clarified goals.

The process Rafe and Liz experienced in building a home is a perfect analogy to creating a sound, effective financial plan. For that reason, I call this process “The Blueprint for Financial Success.”

What Difference Does It Make?

When we talk about financial plans, some people roll their eyes and think, Good grief. That sounds so boring! But having a workable plan is essential to a life of peace, contentment, and fulfillment. Blundering along in life without a plan is a sure way to raise levels of anxiety, fear, confusion, and tension between family members. It takes a little work, but the benefits are enormous! Before we get into the process, let me tell you about a few people who found it helpful.

Suzanne is a single mom who was buried in debt. She was raising two children on a job that didn’t pay well. She came to my office and shared her hopes and dreams. As we talked, I asked her about her goals as well as her assets, liabilities, and expenses. One of the things she really wanted to do was to take her sons on a nice vacation to Europe. That was her dream, but she didn’t see any way that could happen. Her first goal was to get out of debt.

One of Suzanne’s expenses was smoking cigarettes. We calculated that she was spending $40 a week on cigarettes. “I’ve tried to quit,” she told me, “but I guess I haven’t been too motivated.” I showed her that by saving the $40 a week, she’d have over $2000 in a year. For some reason, this reality had never dawned on her. Actually, we found several other expenses that she could eliminate, like cable television and some magazine subscriptions, and in the end, she chose to keep cable but drop the magazines.

As the year went by, Suzanne was able to pay off $1500 in debts, and a year after she came to see me, she took her boys on a vacation to the beach in Florida. When she got back, she called to tell me, “Jim, it wasn’t Europe, but we had a great time together. And I feel even better because I’m not in debt any more. Thank you!”

Robert and Rebekah had a bunch of fun friends, and they tried to do everything their friends could afford. They took nice cruises with them, Robert bought the finest fishing gear so he would look good when he went with his buddies, and Rebekah shopped at upscale stores with her friends. When they came to see me, they were a classic case of living barely above water. They had gone years without owing any money, but they spent every dime they earned. Recently, some medical bills had put them over the edge, and they realized that something needed to change.

As we talked, they realized they were locked into the lifestyle they were living. They needed an emergency fund and some investments for the future, but these choices conflicted with their deep desire to maintain their spending levels so they could keep up with their friends.

We outlined what matters most to them, and they finally decided that the peace of having a cushion outweighed (but just barely) their desire to keep spending to be accepted by their friends. We designed a budget, and with only a few changes (from my perspective) about some important expenses (from their perspective), they were able to put hundreds of dollars each month into an emergency savings fund and then into a mutual fund.

A year later, they came to see me, and they were thrilled! They felt great about their growing nest egg, and Rebekah explained, “When I told my friends what Robert and I were doing to save money, several of them decided to do the same things. They were as afraid of losing friends as we’d been, so we made changes together.”

Six years ago, Steven was in his mid-30s, and he had a dream. He always had a knack for technology, and he had been tinkering with a new device that would make offset printing cheaper but with higher quality. He patented his invention, and he took his concept to investment bankers in New York. They loved the idea, and they backed him in creating a new company.

Steven was, to say the least, dedicated to his new company. He flew all over the country meeting with printing companies, and he often flew to New York to meet with his investors. When he was in town, he regularly worked 16- or 18-hour days, 6 or 7 days a week. His company was doing well . . . very well. When Steven came to see me, his company was five years old. That year, it had grossed over $100 million, and his personal net worth had skyrocketed to $50 million. But the day before, his wife had contacted an attorney to start divorce proceedings, and his children despised him so much they refused to talk to him. Steven was distraught, but he was so immersed in running his business, his cell phone never stopped ringing during the hour we talked.

From the look on his face, I realized he needed more than a little financial advice. He needed a complete change in his life’s priorities.

I met with Steven several times to talk about what matters most to him. He realized that his preoccupation with his career and money was costing him the people he loved most. The reality of their hostility shattered him, and one day, he called to tell me he was thinking of taking his life. A few minutes later, we met, and I took him to see a counselor. In the weeks that followed, some amazing things happened. Steven mustered the courage to make changes—not superficial ones, but drastic ones. He hired someone to take over his business as the CEO, and he became the board chairman with far fewer responsibilities.

He asked his wife and children for forgiveness, and he made it his aim to earn their trust and respect again. That road had many ups and downs, but eventually, his marriage was restored. One of his children now cherishes her father, but the other hasn’t yet found the faith to trust him.

No amount of money and no level of business success could fill the hole in Steven’s soul. He had almost lost everything, but a hard look at his life enabled him to make decisions to reclaim what mattered most to him.

From time to time, people come to my office who inspire me. When I ask them the questions about their life’s purpose, their eyes light up, and they tell me about the passion that gets them up each morning and keeps them from sleeping at night because they are so excited about it. Charles and Diane are like that. When I met with them, they told me about their work with the homeless. They don’t just donate money. They give generously of their funds, but they give even more of their time and their hearts. Diane told me, “Jim, you have no idea how it thrills me to be able to help a young mother on the street who desperately needs food and medical care for her baby.”

Diane and Charles explained that they got into this work almost by accident, but it captured their hearts. A group from their church asked Charles to drive the youth group’s van so they could take some food and clothes to homeless people. Diane went along for the ride. Neither of them realized how God would touch their hearts that day. They are well connected, so they garnered resources and commitments from a number of churches and social organizations. In addition to food and clothes, they are providing job training and placement, reading skills, and courses in self-protection. Today, they are making a huge difference in hundreds of lives.

Why, you might ask, did they come to see me? Charles told me, “We want to maximize our impact with those dear people, and we want you to help us.” Gladly, sir, gladly.

Financial planning may begin with a commitment to responsibility, but it results in tremendous satisfaction. A friend told me about the sheer delight of providing for his now grown children.

He said, “When my kids were little, I wanted to be sure they had a good education. I knew I couldn’t afford to send them to an expensive college, but I wanted to at least send them to a state university. My wife and I started a college fund for them, and by the time they went to college, we had enough. I remember the enormous sense of satisfaction when I wrote that first check for my daughter’s tuition, room, and board. And I felt the same way every semester for her four years and my son’s four years, too. I had done what I set out to do, and it felt great!”

Blueprint Overview

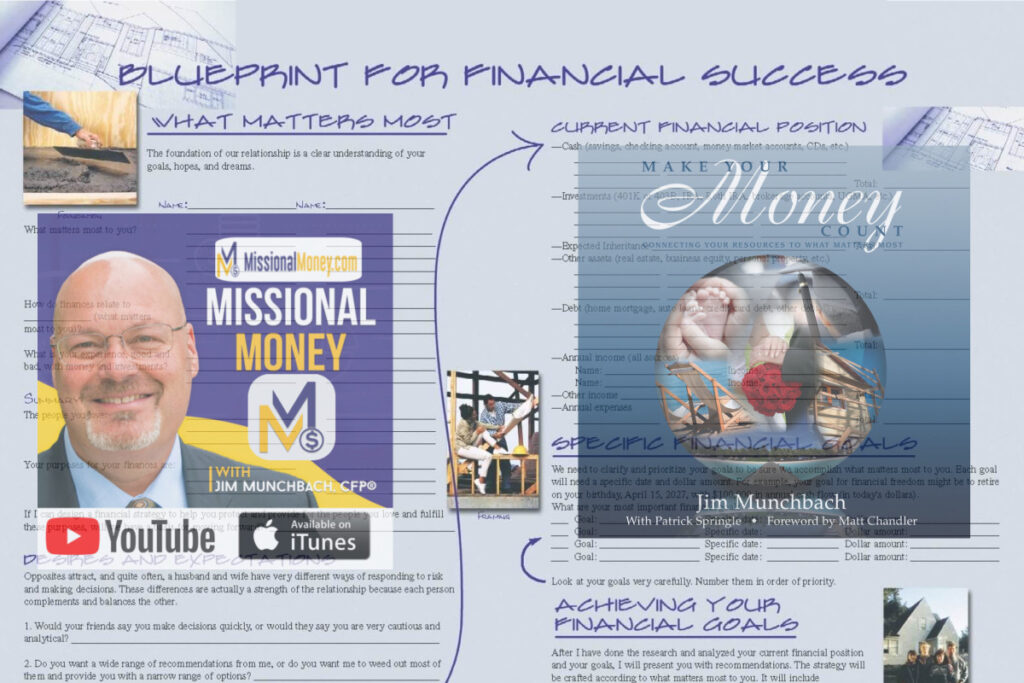

The Blueprint has three sections: defining what matters most to you, a snapshot of your current financial position, and setting specific goals for your future.

In the first three chapters of this book, we focused on your vision and identified what matters most. That’s crucial, but it’s only the first step. In this chapter, we’ll be intentional by setting goals, and in the remaining chapters, we’ll examine the nuts and bolts, the means of achieving your goals. Setting goals is an important step that will guide our decisions about money. For most of us, our goals include our children’s college education, weddings, family vacations, retirement, a cause that inspires us, and perhaps a significant hobby. Some people may want to save enough to start their own business or buy a boat or a vacation home. And some people need to have enough money to adopt a child or provide extensive medical care for a family member.

The Blueprint isn’t magical, and it isn’t strange. It’s a straightforward look at those three elements of an effective financial plan, and it prepares you to take steps to accomplish your specific goals and fulfill your dreams.

>Okay, we’re ready. Get your pencil out, and let’s get started.

The Blueprint for Financial Success

Part 1: The Foundation

What Matters Most to You

Based on the reflection you’ve done in the first three chapters…

-

What and who matter most to you?

-

How do finances relate to what matters most to you?

-

What is your experience, good and bad, with money and investments? (Reflecting on your financial experiences is a good first step as you design a workable plan to connect your resources to what matters most.)

Common Purposes…Or Not

Opposites attract, and quite often, a husband and wife have very different ways of responding to risk and making decisions. These differences are actually a strength of the relationship because each person complements and balances the other.

-

Would your friends say you make decisions quickly, or would they say you are very cautious and analytical? What would they say about how your spouse makes decisions?

-

In what ways do your answers about what matters most complement or compete with your spouse’s answers?

-

Regarding financial issues, who is the decision-maker in the family? Would your spouse agree?

-

Describe any common sources of tension in how you and your spouse handle money.

Part 2: The Framing

Your Current Financial Position

In this section of the Blueprint, you take a snapshot of your current financial position. Be rigorously honest and make an accurate assessment.

When I work with clients, I ask them to bring every piece of information that has to do with their money: bank statements, IRAs, 401k’s, other investments, mortgage information, auto loans, credit card balances and other debts, and all sources of income and a copy of the budget if they have one.

One client asked me if he should include some family debts. That’s a good question, and one that’s not easily answered. Many people fail to list money they’ve borrowed from family members as debts they owe. Somehow, they seem to think it doesn’t really count—and it doesn’t if they don’t intend to repay it, except in their consciences.

Similarly, many people don’t list money owed to them by family members as assets because, I assume, they aren’t sure they’ll be paid back. The point here is that there’s no need to list money owed by you or to you if there’s little chance of it being paid. I would, however, encourage people to make a commitment to pay back any money borrowed from parents, siblings, friends, or employers. They may have given up on it, but they’ll be glad to be surprised by your check!

Let me give you an example of a snapshot of a couple’s financial position. John and Krista are in their early 30s with two small children. Both of them worked until their first child was born. Krista put her career on hold to be at home, but their income, of course, was cut in half. When they came to see me, they realized they needed to plan effectively so they could provide for their family. First, they articulated what matters most. They told me that they have two passions: their family and their volunteer work at a food pantry.

The next step for John and Krista was to take a snapshot of their finances. Here’s what they listed under “assets”: —Checking account: $2525 —Emergency savings account: $3400 —John’s 401k: $58,560 —Krista’s 401k: $22,985 —Intel stock given to Krista by her father: $15,300 —Mutual funds: $17,775 —Market value of their home: $205,000 —Cash value of Krista’s life insurance policy: $16,150 —Blue book value of John’s car: $4500 —Blue book value of Krista’s van: $14,700 The total of their assets was $360,895.

Soon after they were married, John was able to pay off his college loans and pay for his car. Under liabilities, they listed: —Auto loan on Krista’s van: $13,290 —Credit card debt: $500 —Mortgage on their home: $165,455

The total of their liabilities was $179,245. Their net worth came to $181,650.

Now it’s your turn. List every asset and liability:

Assets

—Cash (savings, checking account, money market accounts, CDs, etc.) put 3 lines under this for a number to be written —Investments (401K or 403B, IRA, Roth IRA, brokerage accounts, UGMA, etc.) 5 lines for numbers —Other assets (real estate, business equity, vehicles, personal property, etc.) 2 lines Total Assets___

Liabilities

—Debts (home mortgage, auto loans, credit card debt, other debt) 4 lines for numbers Total Liabilities_____

Assets minus Liabilities equals Net worth____

For budgeting purposes, list salaries as the annual income for your family. —Monthly or Annual Income Name:________Income:______ Name:________Income:______ —Monthly or Annual Expenses Name:________ Expenses:______ Name:________ Expenses:______ —Monthly surplus or deficit:__ —Annual surplus or deficit:___ ![[BP-Finish.jpg]]

Part 3: The Finish

Your Specific Financial Goals

Some of us are gifted at setting good, clear goals, but others need some help. Popular author and speaker Brian Tracy wrote, “Successful men and women invest the time necessary to develop absolute clarity about themselves and what they really want, like designing a detailed blueprint for a building before they begin construction. Most people just throw themselves at life like a dog chasing a passing car and wonder why they never seem to catch anything or keep anything worthwhile.” *[Brian Tracy, Goals!, (Berrett-Koehler Publishers, San Francisco, 2003), p. 50.]

As you consider your goals, think about these principles:

—Goals must be your own. Don’t just adopt your parents’ or your friends’ goals. Take time to think about what you really want, and make them your own. You’re more likely to accomplish them if you’re personally invested in them.

—Consider what concerns you most. Is there anything that gnaws at your soul and won’t let you sleep because you’re so worried? Resolving that problem is a high priority for you. Make it a goal, and establish a strategy to accomplish it.

—Find someone who inspires you. I love the story of Jim Ryan, the first man to break the four-minute mile. Most people thought running a mile in less than four minutes was impossible, but Ryan was determined to prove them wrong. His autobiography, In Quest of Gold, tells how he set that goal and accomplished it in spite of long odds. Ryan is an inspiration to me and to anyone who has been told that we can’t achieve our dreams.

—Crystallize your thinking. Some people benefit from imagining a scenario that forces them to think more clearly. For instance, imagine that you just found out that you have a terminal disease and you have only six months to live. What would your goals be? Or think about what it would be like to enjoy your 90th birthday party. Where will you have the party? Describe the details of that party. Who would be there? What will they be saying about you, and what do you want them to say about you?

—Prioritize. All goals aren’t equally important, and each of the four types of people (buried in debt, etc.) will have different specific goals, at least for the short-term. Be disciplined and determined to focus on the most important goals first.

—Reexamine your goals from time to time. Things change. Births, deaths, graduations, weddings, promotions, hurricanes, floods, fires, illnesses, injuries, and other major events can affect your goals. Don’t be too rigid, but learn to be flexible to tailor your goals to fit your current situation. Identify your goals and prioritize them to be sure you accomplish what matters most to you. Each goal will need a specific date and the funding required. For example, your goals might include: —college education for your children —a nice wedding for your daughter —meaningful vacations for your family —paying off the mortgage on your home —a comfortable retirement; for instance, to retire on your birthday, April 15, 2027 with $100,000 in annual income (in today’s dollars) —starting a business —caring for an elderly parent or a disabled spouse or child

John and Krista had already identified their goals, but they wrestled with the projected amounts and dates when they would need the money. In their calculations, they figured that Krista would go back to work after Angela, their younger child, finished high school. Their goals are:

—College expenses for Jason Amount needed for a state university: $80,000 Beginning: August 2021 —College expenses for Angela Amount needed for a state university: $80,000 Beginning: August 2023 —Wedding for Angela Amount needed: $35,000 Date needed: about 2027 —Family vacations Amounts needed: an average of $3000/year Dates needed: yearly —Retirement Amount needed: $150,000/year (adjusted for inflation) Date needed: beginning on John’s 65th birthday, March 22, 2041

John and Krista determined that their top priorities are college expenses for the children and meaningful family vacations.

What are your most important financial goals?

—Goal #1: Specific date: Dollar amount: —Goal #2: Specific date: Dollar amount: —Goal #3: Specific date: Dollar amount: —Goal #4: Specific date: Dollar amount:

Look at your goals very carefully. List these in order of priority.

Achieving Your Financial Goals

Look at each of the goals you have prioritized. What will it mean to you to accomplish each of these?

The Blueprint for Financial Success FREETIC

Essential Elements of a Financial Strategy

FREETIC is an acronym that begins with Financial Freedom (or Retirement Planning) and then includes each of the elements of financial planning as outlined in the Certified Financial Planner™ process.

FREE TIC is the simple acronym I like to use (in my head) to help me stay on track when creating (and presenting) a comprehensive financial plan.

My approach to financial planning is generally focused on FREEDOM. I want to have lots of options in my life and I assume that’s true for each and every person I meet. What about you?

Financial freedom (or retirement)

Some people want to work the rest of their lives, but others eagerly anticipate retirement so they can travel and devote more time to hobbies, their families, and some important causes. After he retired, my friend Buck transitioned from full-time employment to serving as one of the leaders of our church’s men’s ministry. His definition of retirement is simple: “It’s when I stopped working for money, and money started working for me.”

Whether you actually quit work, continue working, or change vocations to become a full-time volunteer, you need a clear plan to achieve financial freedom and accomplish your dreams. Buck paid close attention to his plan, and his plan continues to pay big dividends today.

Risk management

We deal with many risks, ranging from minor car accidents to catastrophic injury or death. All of us need adequate property and casualty insurance, as well as life insurance. In addition, we need to consider other ways to lower our risk. Experiences of long-term illnesses and disability can cause severe financial hardships, and they can be a burden on those we love. Some of the pain can be alleviated with properly planned insurance.

Education planning

It is important to start putting money aside for college as early as possible. There are many options, each with specific features. Education planning can be challenging because of the complexities of tax considerations, management fees, parental income limitations, and other issues. For example, some accounts charge a penalty if the money isn’t used for college costs. Saving money, borrowing money, and financial aid are some obvious ways to pay for college. As you plan, remember that the inflation rate for college expenses is higher than the rate for other goods and services.

Your overall financial strategy should include a wide range of solutions that insure your children will be able to attend college to achieve their dreams.

Estate planning

Estate planning is a process that determines how to distribute your property during your life and at your death according to your goals and objectives. Without advance planning, more of your assets may go to the federal government in taxes instead of going to the people you love.

The issues that will affect your estate include taxes, probate, liquidity, and incapacity. Your strategy can consist of solutions that are simple and inexpensive (e.g., a will or life insurance). If your estate is large the process can be complex and expensive, and it’s wise to involve professionals in estate planning. Even modest portfolios, however, can grow into large ones if they are managed properly, so every person needs to consider estate planning, either now or in the future.

Tax planningThe goal of tax planning is to minimize federal income tax liability while maximizing the after-tax return on investments. Typically, deferring some income in a 401k, 403b, deductible IRA, or other tax-advantaged accounts reduces taxable income. Roth IRA’s are excellent vehicles for many Americans to save for tax-free income.

Each person’s tax planning strategy is based on individual income and should include solutions that defer taxes and offer tax-free growth whenever possible. Some individuals need expert tax advice in order to design the best strategy, but standard solutions work well for most people.

Investment planning

Almost limitless choices are available to every investor. Your strategy must be designed to get the highest return within your tolerance for risk and your time horizon. No one can guarantee a profit or protect against a loss in a declining market, but diversification limits risk, and dollar cost averaging (using automatic deductions) takes some of the guesswork out of investing. Asset allocation is the most important step in diversifying your portfolio. You can balance risk and return by spreading your dollars among different types of assets, such as stocks, bonds, and cash equivalents. Different types of assets carry different levels of risk and potential for return, and these investment vehicles typically don’t respond to market forces in the same way at the same time.

A long-term strategy will help you ride out the ups and downs of the market to build a sizeable investment account over your time horizon.

Cash flow

Cash flow (or budgeting) is a process to measure, plan, and prioritize your spending and saving. Your commitment to financial success requires a clear strategy for managing all aspects of your income and expenses. An analysis of cash flow is the starting point in any financial strategy. Analyze your current financial position honestly and realistically, clarify your goals, and develop a clear financial strategy. On an annual basis, measure your progress.

Working with a Professional

When Rafe and Liz decided to build their house, they knew they didn’t have the expertise to design it and build it themselves. That’s why they hired an architect and builder. In the same way, few of us have the savvy to design our own comprehensive financial plans. We may need some assistance and guidance from a professional to help us make the best decisions so that our dreams and goals are fulfilled.

Many of the calculations that seem overwhelming to you are the stock-in-trade of financial professionals. Your role is to clarify the vision and have a firm intention to fulfill your goals; the professional’s role is to provide the technical means. For reasons we’ll examine in a later chapter, some people don’t see financial professionals as trusted resources. That’s too bad, because a good professional may help you identify and prioritize your goals, and they may provide valuable insights about choosing the best investments to achieve your goals more quickly and with less stress.

The Blueprint for Financial Success is a powerful tool to help you and your financial advisor put it all together.

Solomon’s Advice on Financial Planning

King Solomon was the classic example of someone who had bucks in the bank, but without peace. He ruled the nation, and he commanded the army. He had fabulous wealth, and he indulged himself on parties, infinite sex, palatial homes, and possessions beyond counting. But all the wealth and pleasure in the world couldn’t fill the hole in his heart. He complained, “I’ve been king over Israel in Jerusalem. I looked most carefully into everything, searched out all that is done on this earth. And let me tell you, there’s not much to write home about. God hasn’t made it easy for us. I’ve seen it all and it’s nothing but smoke—smoke, and spitting into the wind” (Ecclesiastes 1:12-14). Even though he was disillusioned, God gave him wisdom to understand how life is supposed to work.

My friend Matt Chandler is the lead pastor of The Village Church in Flower Mound, Texas. My wife and I love to listen to his messages. *[Matt’s podcasts are free through itunes or at his website: http://www.thevillagechurch.net/resources/sermons.html]

Consumers Anonymous

In a study of Ecclesiastes, Matt painted a vivid portrait of King Solomon’s lifestyle of rampant consumption. At the end of Solomon’s grand, self-indulgent experiment, he warned that everything in life is meaningless without God. But life doesn’t have to be that way. Matt challenged people to develop “a sixth sense” in following Jesus to a rich, meaningful life.

Matt explained, “When our lives are directed by a transcendent purpose, money can just be money. It no longer becomes our master, and we don’t have to have it to gain some kind of social status. We can give money away or buy a house, and it doesn’t own us. Christ removes futility and vanity from our souls and gives us the purpose you and I are dying for.

Everything else under the sun is running on a treadmill. My hope is that you’ll honestly evaluate life, and you’ll begin to look beyond the Sun. And I hope you and I develop—even more fully—the sixth sense of faith in Jesus Christ.”

The complexity of today’s financial vehicles may be a recent phenomenon, but the need for good planning is as old as civilization. Jesus had more to say about money than almost any other subject. In fact, a third of his parables focused on how people handle money.

Why is money so important to God? Because the way we use money reveals what’s in our hearts, and our courageous choices about money shape the direction of our lives. Solomon wrote about the importance of planning almost a millennia before Jesus. He wrote, “Careful planning puts you ahead in the long run; hurry and scurry puts you further behind” (Proverb 21:5.)

One of the chief problems, Solomon observed, is that some people are just too lazy to plan. Perhaps they think someone else will take care of them, or they don’t see the benefit of spending a little time to provide resources for the people they love, or maybe they haven’t determined what matters most to them so they aren’t motivated to do the little bit of work necessary for large gains. Whatever the reason, the king noted, “Laziness makes you poor; diligence brings wealth. Make hay while the sun shines—that’s smart; go fishing during harvest—that’s stupid” (Proverbs 10:4-5).

We are wise, Solomon tells us, if we take a hard look at our current condition so we can see immediate or delayed danger. Only the foolish close their eyes to these realities. He encouraged us, “A prudent person sees trouble coming and ducks; a simpleton walks in blindly and is clobbered. The payoff for meekness and Fear-of-God is plenty and honor and a satisfying life” (Proverbs 22:3-4).

“Plenty and honor and a satisfying life.” That’s Solomon’s promise for those who plan for the future. Sure, it takes some time and effort, but the lack of planning produces worry that absorbs our time and depletes our energy. The king encourages us to be smart, not stupid, and to work on our financial plans.

A life of faith is an adventure. Sometimes, we have to make hard decisions, and it seems that God is a million miles away. But at other times, we see him provide for us and lead us very clearly. The more we grasp God’s greatness and goodness, the more we’ll trust him—even when we don’t sense his presence. As we trust him, we’ll worry far less. In his most famous talk, Jesus told us that God provides for us in incredible ways. He said, “That is why I tell you not to worry about everyday life—whether you have enough food and drink, or enough clothes to wear. Isn’t life more than food, and your body more than clothing? Look at the birds. They don’t plant or harvest or store food in barns, for your heavenly Father feeds them. And aren’t you far more valuable to him than they are? Can all your worries add a single moment to your life?” (Matthew 6:25-27).

Think about it…

-

Were you able to calculate and write down your total net worth? If so, were you encouraged or disheartened by the reality of that number? Explain your answer. If you couldn’t complete this section now, will you commit to taking the time to calculate your net worth in the next 30 days?

-

Are your goals clear or vague at this point? How will it affect you (your attitude, relationships, confidence, etc.) when you have clear financial goals and a powerful strategy to achieve them?

-

In the next chapter, we’ll examine the elements of a financial strategy, but as you read the brief descriptions of them in this chapter, which ones seem most important to your goals? Explain your answer.

-

Would the services of a financial planning professional help you? Why or why not?

Going deeper

-

On a scale of 0 (stupid, a simpleton) to 10 (smart, prudent, a careful planner), rate your financial planning abilities up to this moment in your life. Explain your answer.

-

Rate your motivation from 0 to 10 to create an effective financial plan. Do you really believe that having an effective plan will result in more clarity, confidence, and contentment in your life? Why or why not?

-

If you had only six months to live, what would your priorities be? How could you use your resources to accomplish those priorities?