Cash Flow Management: Optimize Your Financial Resources with an Independent Fiduciary Advisor

Cash flow management can help you optimize your financial resources. At BayRock Financial, you work with an Independent Fiduciary Advisor who specializes in cash flow management. We start by conducting a thoughtful Gap Analysis and coordinating with your advisory team to create a well-coordinated financial plan. Learn how our independent fiduciary advisor can help you connect all the dots and achieve better control over your finances.

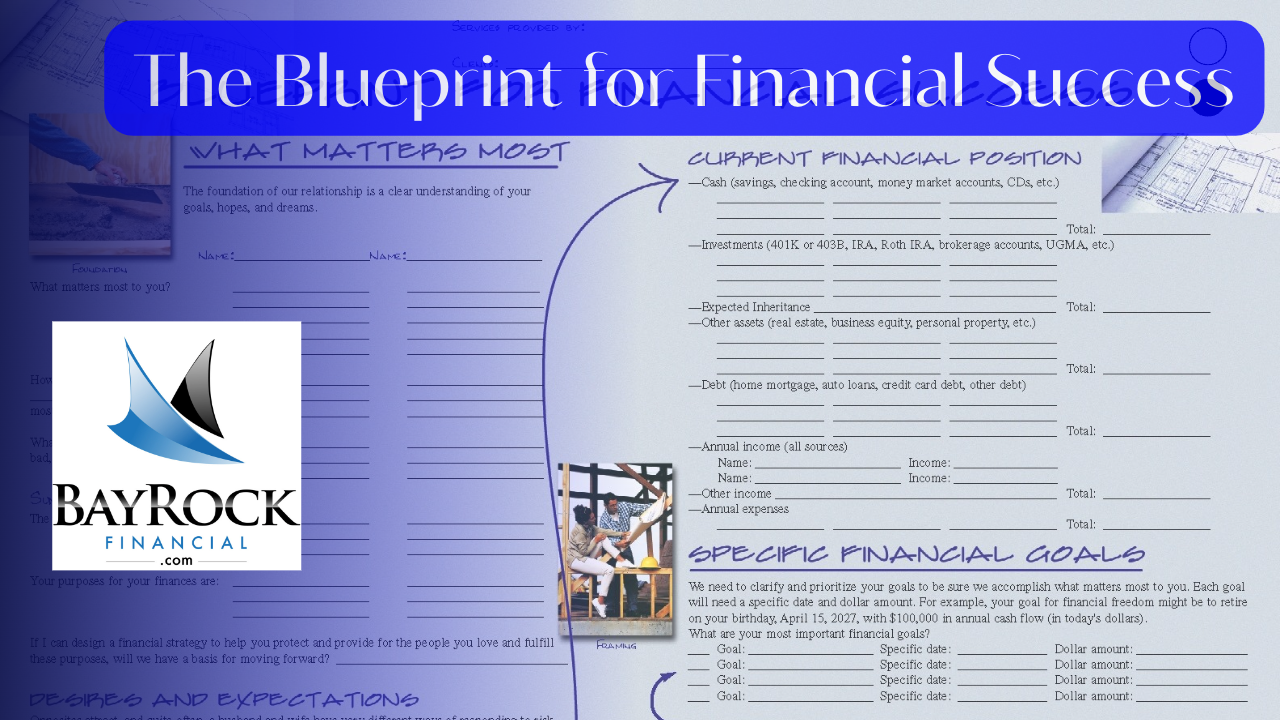

Cash flow management plays a crucial role in optimizing your financial resources and achieving your financial goals. At BayRock Financial, we understand the importance of cash flow management and the need for an independent fiduciary advisor who conducts a thoughtful Gap Analysis and coordinates with your advisory team. Let’s explore how our team can help you develop comprehensive cash flow management strategies and create a holistic financial blueprint.

The Benefits of Working with an Independent Fiduciary Advisor

Working with an independent fiduciary advisor offers several benefits, including:

-

Thoughtful Gap Analysis: An independent fiduciary advisor conducts a thoughtful Gap Analysis, evaluating your current financial situation and identifying areas where your financial goals may not align with your resources. This analysis provides valuable insights and serves as a foundation for developing effective cash flow management strategies.

-

Unbiased Advice: An independent fiduciary advisor has a fiduciary duty to act in your best interest. They provide unbiased advice that is free from conflicts of interest. Their focus is solely on helping you optimize your cash flow and achieve your financial objectives.

-

Advisor Coordination: Advisor coordination is key to a well-coordinated financial plan. Often, professionals in different financial disciplines do not communicate effectively. An independent fiduciary advisor bridges that gap by coordinating with your CPA, family attorney, insurance agent, and investment advisor. This ensures that all aspects of your financial plan work together seamlessly.

-

Holistic Financial Blueprint: An independent fiduciary advisor helps you create a holistic financial blueprint that connects all the dots in the right scope and sequence.

Your Independent Fiduciary Advisor will consider all the essential elements of your financial life, such as retirement planning, risk management and insurance planning, estate planning, education planning, tax planning strategies, investment management strategies, and cash flow management.

Comprehensive Cash Flow Management Strategies

Comprehensive cash flow management strategies involve various elements of your financial plan. At BayRock Financial, our independent fiduciary advisor can assist you in developing strategies for:

1. Budgeting and Expense Control

Our advisor will help you develop a comprehensive budget that aligns with your financial goals. We will work with you to analyze your expenses, identify areas for potential savings, and implement strategies to control spending.

2. Debt Management

We will assess your debt situation and develop a plan to manage and reduce your debts effectively. Our advisor will help you explore options for consolidating debts, refinancing loans, and developing strategies to pay off debts efficiently.

3. Income Optimization

We will analyze your income sources and explore opportunities to optimize your earnings. This may include strategies such as negotiating salary increases, maximizing income from investments, and exploring alternative income streams.

4. Cash Reserve Planning

We will help you establish an emergency fund and develop strategies to ensure you have adequate cash reserves for unexpected expenses or financial downturns. Our advisor will assist you in determining the ideal amount to save and the most suitable vehicles for your cash reserves.

5. Financial Goal Alignment

We will align your cash flow management strategies with your financial

goals. Our advisor will work with you to prioritize your goals, allocate resources accordingly, and ensure that your cash flow supports the achievement of your long-term objectives.

Cash Flow Management for Better Financial Planning

Effective cash flow management is essential for optimizing your financial resources and achieving your financial goals. At BayRock Financial, our independent fiduciary advisor specializes in cash flow management, conducting a thoughtful Gap Analysis, and coordinating with your advisory team. Contact us today to learn more about how our advisor can help you connect all the dots in your financial plan and develop comprehensive cash flow management strategies to achieve better control over your finances.

Contact us Anytime #AskMeAnything. At Bayrock Financial we’re here when you’re ready to start your retirement planning journey and take a step closer to financial independence.