Financial Coaching for DIY Investors

True wealth is more than just money. It’s living out your life vision, values, and purpose. It’s making sure your legacy survives the next generation. It’s having more clarity, confidence, and contentment in your financial life.

Join Missional Money

Missional Money is a Premium Financial Planning Course, it’s 100% online and on demand. The course is designed to help investors create a compelling financial plan in 14 days – in only 10 minutes a day!

Featuring Make Your Money Count and The Blueprint for Financial Success™ by Jim Munchbach, CFP® Professional. Missional Money is a subscription based course for DIY Investors, Families, and Small Business Owners who want to:

-

Save More Money,

-

Pay Lower Taxes, and

-

Build a Better Retirement

Signup for a FREE 14 Day Trial. After that you will be charged $24.95 per month and you will be included in our Life Study Group Membership program. Click here to Join.

Our goal is to help you pursue your personal, professional, and financial goals. Whether you’re just getting started as an investor, halfway through your career, or preparing for retirement, you need a plan. Most Financial Advisors offer some type of “financial plan” for clients – but most Financial Advisors don’t help clients design a well-coordinated plan. Our process will not only help you gain more clarity, confidence, and contentment in your financial life – we help you take your financial plan to the next level.

Financial Coaching for DIY Investors will teach you how to Make Your Money Count – by connecting all of your resources to What Matters Most. Your vision, values, and purpose. Your goals and priorities. The Blueprint for Financial Success™ is a powerful tool for helping individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose. SignUp for Online Course.

Financial Coaching for DIY Investors featuring The Blueprint for Financial Success™

Financial Coaching for DIY Investors features a powerful tool we call The Blueprint for Financial Success™. Our Financial Coaching will teach you how to use The Blueprint to create Smarter Strategies and Better Results. The Blueprint is for…

-

Individual Investors who want to build a better retirement plan

-

Families who want to equip the next generation

-

DIY Investors who want to create a compelling financial plan

- SignUp for Online Course – Click Here

Meet the Coach

Hi, I’m Jim Munchbach, CFP® Professional. I’ve been providing financial services since 1989. I wrote What Matters Most to help Financial Advisors learn how to deliver Smarter Strategies and Better Results. In my books, I use the metaphor of a “Blueprint” to show you how to create a compelling finanical plan based on your vision, values, and purpose.

My mission is to help individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

What Matters Most for Your Financial Advisors

What Matters Most contains clear principles about building relationships with clients based on trust. I call this kind of relationship a “purpose-centered alliance” because it focuses on the hopes and dreams of the client. What Matters Most is for Financial Advisors, including:

-

Insurance professionals (with securities licenses) who want to serve their clients more effectively by focusing on each person’s individual purpose.

-

Unlicensed team members who can plan a vital role in building trust with clients, and

-

Brokers, accountants, tax preparers, and anyone else who serves in the financial services arena.

From the Cover of What Matters Most

On the cover of What Matters Most, I wrote: “My hope is that reading this book and implementing the principles and skills will revolutionize your life and your business. I hope it changes the way you think, how you are motivated, and what you do with clients. When this happens, you’ll come to work each day knowing you make a difference in people’s lives and you are incredibly relevant.”

Fulfilling Dreams… For Life

Our most precious resource is our relationship with our clients – not our products, not our strategies, not our sales techniques. When people commit their lives, their trust, and their money into our hands, they are giving us a sacred trust. We value them as individuals and treat them with respect, integrity, and care. That’s a “purpose-centered alliance.” Like an arch’s keystone that provides stability to all the other stones, this kind of relationship gives structure and direction to everything we do.

When people are convinced that we care about their goals, hopes, and dreams, they will trust us with more of their assets. Then we’ll have the privilege of fulfilling their dreams – and ours, too.

Allied for Success for CFP® Professionals

Creating a Synergy of Specialists to Fulfill Our Clients’ Dreams by Jim Munchbach, CFP® Professional. Published by FPA Press.

Financial Coaching for DIY Investors – Online Course Sign Up

Featuring The Blueprint for Financial Success™ Financial Coaching for DIY Investors – create a compelling financial plan to manage the risk and opportunity of everyday life, recover from the unexpected, and realize your highest purpose.

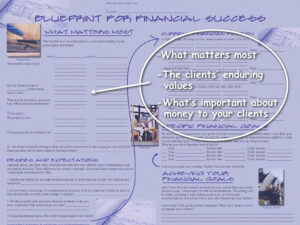

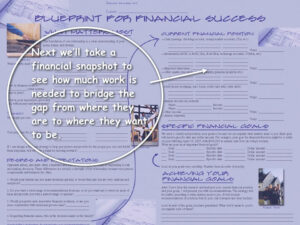

Part One: The Foundation – What Matters Most

Part Two: The Framing – Your Financial Inventory

Part Three: The Finish – Your Specific Goals

Financial Coaching Process

The Blueprint for Financial Success™ is a powerful tool for helping individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

Financial Coaching for DIY Investors

Financial Coaching for DIY Investors is an online self-study self-paced course designed to teach Financial Advisors how to build trust while helping clients create a compelling financial plan based on their vision, values, and purpose. Financial Coaching for DIY Investors features The Blueprint for Financial Success™ Coming Soon! Sign Up today to get on the waiting list. Click Here.

Financial Coaching for DIY Investors – Pricing

Financial Coaching for DIY Investors is available in three price levels. Each monthly subscription level is designed to address three different levels of financial planning needs from simple to more complex. Each subscription level provides additional services. For example, level three includes all of the services listed in levels one and two as well as the “additional services” listed in level three.

The Subscription-Based Financial Planning Fee arrangement is designed to deliver a better value for DIY Investors who need ongoing financial advice, planning, and coaching. Not only will we help you Make Your Money Count, we’ll teach you the principles and the process for creating a compelling financial plan for your clients as outlined in What Matters Most.

When you signup, we’ll send you a special, limited, hard cover edition of What Matters Most along with 3 copies of The Blueprint for Financial Success™ so that you can begin applying these principles

Three Price Levels

-

Wealth Builder: Starting at $125 per Month

-

Retirement Strategies: Starting at $250 per Month

-

Family and Business: $500 per Month

Level One – Wealth Builder Blueprint, $500 upfront planning fee plus a $125 monthly retainer. Ideal for beginners with typically under $500,000 of investable assets.

The $500 upfront planning fee includes…

-

Gathering client data,

-

Building a comprehensive financial model,

-

90 minute Discovery Meeting,

-

The Blueprint for Financial Success™

The $125 monthly retainer includes…

-

CFP® Coaching (Ongoing communication with a Certified Financial Planner™ professional throughout the planning process. Includes a personal conversation each quarter (either in the office or via screen-share).

-

Investment Design and Oversight (a twice-yearly review of company sponsored Retirement Plan, IRA, Roth IRA, and other investment accounts. Annual review of all investment assets along with planning recommendations designed to help you achieve your financial goals).

-

Blueprint Design (a BayRock Certified Financial Planner™ professional works with each client to build a comprehensive financial model (Blueprint) designed to help connect your financial decisions with your vision, values, and purpose. The Blueprint is used to provide clear direction throughout the planning process).

All subscription fees are paid by invoice through AdvicePay.

Level Two – Retirement Strategies Blueprint

$500 upfront planning fee, plus a $250 monthly retainer. Ideal for Retirement Planning for individuals or couples with typically over $500,000 of investable assets.

The $500 upfront planning fee includes all services listed in level one as well as the following:

– Gap Analysis covering listed areas of personal financial planning:

-

Retirement,

-

Risk Management,

-

Estate Planning,

-

Education Planning,

-

Tax Planning,

-

Investment Planning,

-

Cash Flow Analysis

The $250 monthly retainer includes all services listed in level one as well as the following:

-

Retirement Income Strategies. Building your retirement income strategy starts with a good understanding of what you’d like your retirement to be like — and what your lifestyle will cost. There’s no one-size-fits-all retirement income strategy because every retirement portfolio is different. After getting to know your priorities, a BayRock Certified Financial Planner™ professional will help you understand the risks and opportunities of each strategy recommendation. BayRock Retirement Income Strategies are focused on four primary considerations:

-

Growth potential: While it is important that the growth of your investment portfolio outpaces inflation, BayRock works to balance the need for growth against the risk of exposing your savings to excessive market fluctuations.

-

Principal preservation: Knowing that your investments are safe can help you sleep better at night. Some investments are designed to preserve your principal (ie: money market funds, CDs or Treasury bonds). However, these safe investmentscome with a different kind of risk. Safe investments typically offer relatively low yields. If your principal is not large enough to generate sufficient income from interest and/or dividends to fund your desired retirement lifestyle, your savings may not keep pace with inflation.

-

Liquidity and Flexibility: Having control over your assets and immediate access to fund emergencies is an important consideration. However, having immediate access (liquidity and flexibility) typically limits the ability to create a steady stream of reliable income.

-

Guaranteed income: Investment returns can fluctuate significantly. Certain insurance products, including Treasury bonds, Certificates of Deposit, and fixed and variable annuities, can often provide an income stream that provides greater certainty. Annuities typically come with fees and withdrawal penalties that can restrict your flexibility when an unexpected need arises.

-

Social Security Optimization. Your BayRock Certified Financial Planner™ professional will help identify the best strategy to optimize your monthly Social Security benefit.

Our Social Security analysis is focused on the following three areas:

-

Life Expectancy Analysis. We’ll get to know more about your family history and current health status. With the help of your health care providers you can get a realistic idea of how long you might live. Most retirees underestimate their life expectancy. Your Life Expectancy is essential element to consider in order to optimize your Social Security monthly benefit. If your family has strong longevity, it can make sense to delay your benefits. However, if you have serious or chronic health issues, it typically makes sense to claim earlier.

-

Benefit Availability. BayRock will analyze how much your income would be each month if you drew on Social Security at an earlier age vs. a later age. We then contrast these amounts with your lifetime benefit at each age. We will ask you to provide your estimated social security benefits statement which is now available to you online. Your range of benefits should consider any spousal benefits which we will also include in our analysis as appropriate.

-

Income Gap Analysis. Our planning process will identify any income gaps in your overall financial plan. We conduct further analysis to determine how your Social Security benefits (available to you at various ages) can be optimized for the purpose of filling income gaps in your financial plan over the life of your plan.

-

Blueprint Design. A BayRock Certified Financial Planner™ professional works with each client to build a comprehensive financial model (Blueprint) designed to help connect your financial decisions with your vision, values, and purpose. The Blueprint is used to provide clear direction throughout the planning process. During the implementation phase, “The Blueprint” is a helpful tool for tracking progress each step of the way, including your Retirement Income Strategies as well as any Social Security Optimization strategies that are part of your plan.

Blueprint Implementation. Level Two – Retirement Strategies Blueprint includes an ongoing (in-depth) analysis and review of the personal financial planning elements listed:

-

Retirement,

-

RiskManagement

-

EstatePlanning,

-

EducationPlanning,

-

TaxPlanning,

-

InvestmentPlanning,

-

Cash Flow Analysis

All subscription fees are paid by invoice through AdvicePay.

Level Three – Family and Business Blueprint

$500 upfront planning fee, plus a $500 monthly retainer. Ideal for families and business owners with typically over $1,000,000 of investable assets.

The $500 upfront planning fee includes all services listed in level two as well as the following:

– 90 minute Discovery Meeting (client),

– 90 minute Discovery Meeting (family),

– Gap Analysis covering all areas of personal financial planning listed:

-

Retirement,

-

Risk Management,

-

EstatePlanning,

-

Education Planning,

-

Tax Planning,

-

Investment Planning,

-

Cash Flow Analysis

– Business Gap Analysis, including initial meetings with Financial Advisory team (CPA, Estate Attorney, Insurance Agent(s), etc, as needed),

The $500 monthly retainer includes all services listed in level two as well as the following:

-

Advanced Tax Strategies, including coordination of investment and tax specialists as needed. Wealthy families and business owners have unique needs and opportunities when it comes to tax planning. A BayRock Certified Financial Planner™ professional will work with your family and/or business to identify and implement advanced tax strategies that may not be available through your CPA or estate attorney.

-

Advisor Coordination. Typically, your CPA isn’t talking to your family attorney. Your family attorney is most likely not working with your insurance agent, and your insurance agent may never have a reason to speak to your investment adviser. At BayRock, we work with your Financial Advisory team to help ensure that our clients have a “well-coordinated” financial plan.

-

Family Governance Meetings. Annual family meetings are an effective way to create a framework of shared vision and purpose. Quarterly family meetings are used to facilitate joint decision-making in order to prepare the next generation to eventually take more control of the family business. Quarterly family meetings are held as needed in our BayRock offices or via screen-share.

-

Blueprint Design. A BayRock Certified Financial Planner™ professional works with your family and/or business to build a comprehensive financial model (Blueprint) designed to help connect your financial decisions with your vision, values, and purpose. The Blueprint is used to provide clear direction throughout the planning process. During the implementation phase, “The Blueprint” is a helpful tool for tracking progress each step of the way.

-

Blueprint Implementation. Level Three – Family and Business Blueprint encompasses any advanced tax strategies relative to your estate plan and/or business, adviser coordination as needed, and family governance meetings as needed. The same ongoing (in-depth) analysis and review of your personal financial planning elements which are listed in level two, are also included for The Family and Business Blueprint:

-

Retirement,

-

Risk Management,

-

Estate Planning,

-

Education Planning,

-

Tax Planning,

-

Investment Planning,

-

Cash Flow Analysis

All subscription fees are paid by invoice through AdvicePay.

Financial Coaching for DIY Investors – Bonus

When you sign up for Financial Coaching (any level), we’ll include one copy of What Matters Most, 3 copies of The Blueprint for Financial Success™, and one special, limited, hard cover edition of Make Your Money Count – connecting your resources to What Matters Most by Jim Munchbach, CFP® Professional

What Leaders say about Make Your Money Count

Stephen R. Covey

This very useful book beautifully demonstrates the “Law of the Harvest.” It is only through planning and preparing financially that you can free yourself from the worry, fear and regret that accompany a drought. By proactively choosing to leave a legacy of faith, love and financial freedom, you become more than what you are.

—Stephen R. Covey, author, The 7 Habits of Highly Effective People and The 8th Habit: From Effectiveness to Greatness

John Ortberg

“Jim has a gift. He can write about money and life in a way that will change how you manage both. Read him and watch God change your heart!”

— John Ortberg, Pastor – Menlo Park Presbyterian Church

Ken Blanchard

“Make Your Money Count stands out from other guides on money management because it drives home an important truth: Clarifying your purpose in life is the essential element in financial planning. The book offers an excellent blueprint for success and provides easy-to-follow steps that will align your money with your best intentions and put your finances in divine order.”

—Ken Blanchard, co-author of The One Minute Manager® and Leading at a Higher Level

Judy Santos

“Jim’s heart and values speak clearly as he integrates biblical principles into the 21st century opportunities and problems of managing money. He weaves practical points through magnetic stories, making it a must read for anyone who wants to finally get it right financially!”

—Judy Santos , Master Certified Coach, Founder and President – Christian Coaches Network Inc.

Ron Blue

“As trusted advisors, we recognize that motivation is the key to change. In Make Your Money Count, Jim Munchbach provides powerful motivations to connect our finances with our purpose in life. This, I know, makes all the difference in the world. I enthusiastically recommend Jim’s book”

— Ron Blue , President, Christian Financial Professionals Network CFPN

“This book shows you how to get complete control over your money and your life, develop a financial plan and achieve complete independence.”

— Brian Tracy – Author – The Way To Wealth

“Make Your Money Count is a book for every person interested in a “holistic” view of money, possessions and the abundant life. Jim Munchbach has effectively zeroed in on the critical elements of living our financial lives wisely. I fully expect this book will change the way you think about money and I highly recommend it. “

— Dave Briggs, Director of the Stewardship Ministry at Willow Creek Community Church

“Jim has a way of communicating simple, practical truths so they change our lives. His compelling writing style and stories breathe life and hope into our efforts to manage money. I recommend this book to people of all ages who want to be more intentional about their finances . . . and their lives.”

—Linda Miller , Global Liaison for Coaching, The Ken Blanchard Companies !

Tom Wright, State Farm agent

“Jim should have titled the book Make Your Life Count because he goes beyond showing you how to manage your finances. He opens our eyes to see what is really important in life —how money and investments can help us reach our life’s goals.”

— Tom Wright, State Farm agent and author: Stop Selling And Start Marketing

Rick Baldwin, Sr. Pastor, Friendswood Community Church

“More than any other book on the market, Make Your Money Count will help you align your money with your heart. With compelling stories and a practical “blueprint” Jim Munchbach will inspire and equip you to manage your finances with fresh vision and purpose.”

— Rick Baldwin, Sr. Pastor, Friendswood Community Church

Books Featuring The Blueprint

Whether you’re an independent investor or a Financial Advisor, The Blueprint for Financial Success is designed to help you manage the risk and opportunity of everyday life, recover from the unexpected, and realize your highest purpose. We offer financial coaching and training for families. We also offer sales training for DIY Investors in all areas of financial services. Sign up to receive updates for our upcoming Financial Coaching for DIY Investors (online course). Our training and coaching all feature The Blueprint for Financial Success™.

Make Your Money Count

Featuring The Blueprint for Financial Success™, Make Your Money Count will help you connect your resources to What Matters Most.

Financial Coaching for DIY Investors who want to learn how to build a purpose-centered alliance – based on trust. The Blueprint for Financial Success™ is a powerful tool for helping individual investors, families, and business owners manage the risk and opportunity of everyday life, recover from the unexpected, and realize their highest purpose.

Financial Coaching for DIY Investors. 98% of Financial Advisors sell some type of financial planning; only 13% of Financial Advisors actually have a plan.