WealthCare Webinar

Build a Compelling Financial Plan Online for $49.95

How to Make Your Money Count $49.95 Online Special

Take a Sneak peek inside our Webinar

Check out our Planning Resources

Before you enroll, take a quick look at the Syllabus for our Fall 2020 Online Personal Finance Course. Take advantage of the Early Bird Special, only $49.95 for a limited time only!

The 3 Laws of Personal Finance

The 3 Laws of Personal Finance is a short video I like to send students before each semester of Personal Finance. Every college graduate can become a millionaire by age 50 by obeying 3 laws of personal finance.

WealthCare Webinar | Create a Compelling Financial Plan Online

Money Study Group

$49.95 Open Enrollment

Personal Finance Online

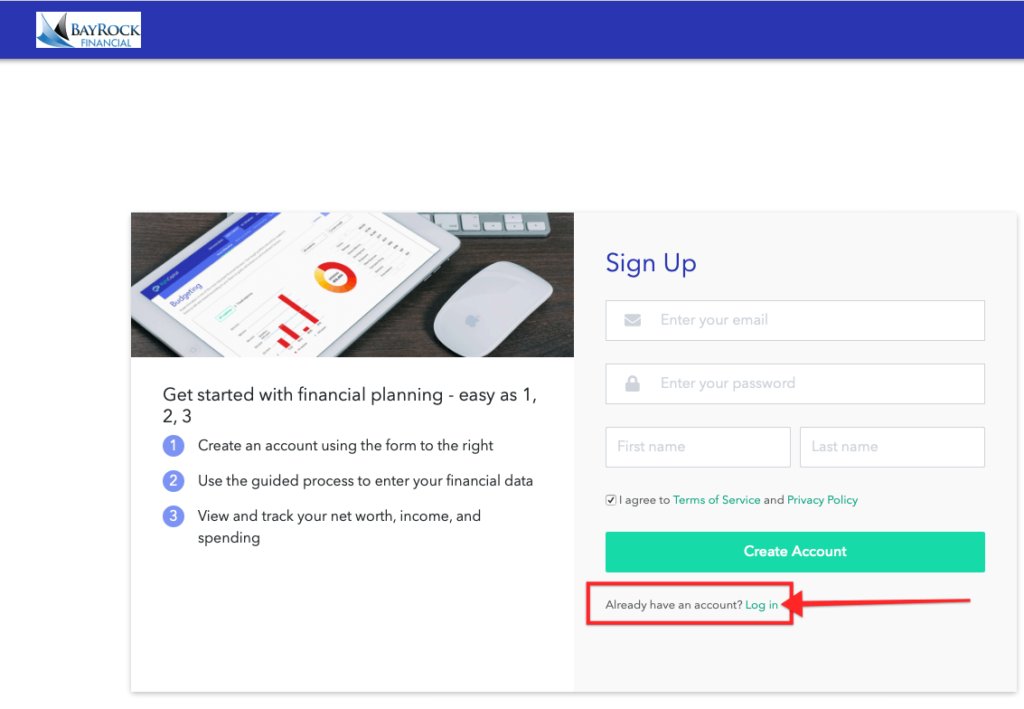

Students get access to our Financial Planning Portal sponsored by BayRock Financial. For 90 Days — for the duration of the Online course in Personal Finance, you’ll have access to one of the best financial planning platforms available on Wall Street with no additional cost — the premium planning portal is provided by BayRock Financial and its being made available as part of your enrollment in Money Study Group.

Login to Planning Portal

Financial Planning

BayRock Planning Portal

At BayRock, we believe every family deserves a quality financial plan – and every plan starts with a Blueprint.

After the first meeting, we encourage every client to take advantage of our favorite technology tool. The BayRock Planning Portal is powered by Right Capital.

Its what we use to deliver Smarter Strategies and Better Results for IRA and 401k Investors.

Make Your Money Count

Make Your Money Count

featuring…

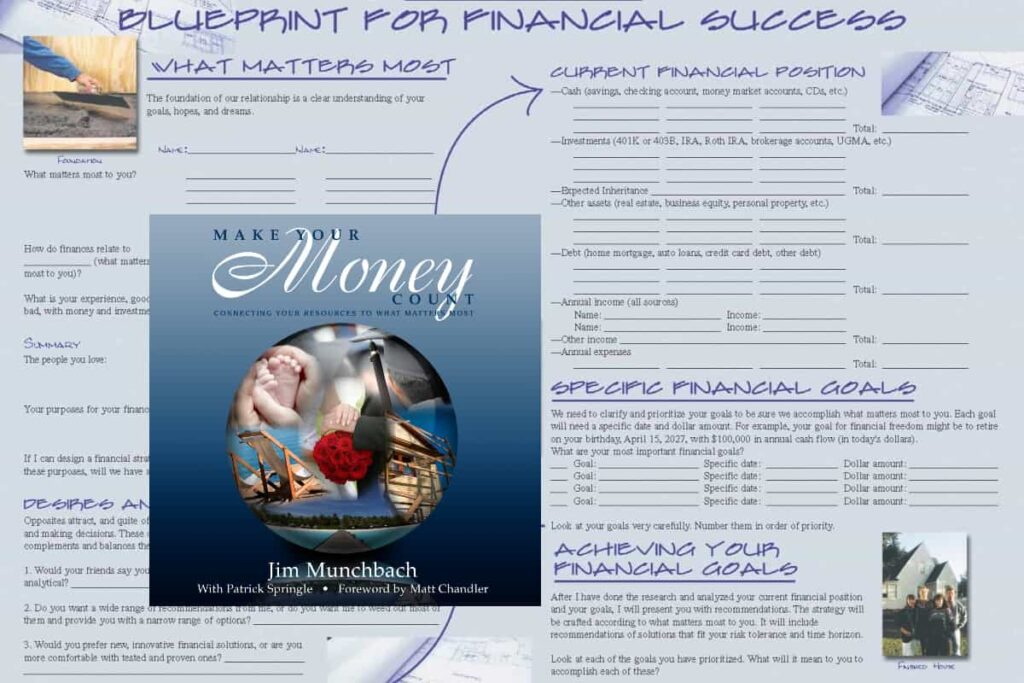

The Blueprint for Financial Success™

Featuring Make Your Money Count by Jim Munchbach, CFP®

What Matters Most

Make Your Money Count, connecting your resources to What Matters Most (your vision, values, and purpose). Start here…

Powered by Purpose

The Process

At BayRock, we believe every family deserves a quality financial plan and every plan starts with a Blueprint.

The Blueprint for Financial Success™

Money Study Group Online Resources

Social Security

Benefits

Social Security is one of the more complicated decisions that you must consider. There are a multitude of rules that can have a significant impact on the amount you will receive each month.

Social Security

Planning Checklist

Will My Social Security Benefit Be Reduced

Social Security is one of the more complicated decisions that you must consider. There are a multitude of rules that can have a significant impact on the amount you will receive each month.

To help make it easier, we have created the “Will My Social Security Benefit Be Reduced?” flowchart. It is based on the Social Security Administration’s guide “Retirement Benefits”. It addresses common issues related to claiming social security:

- How to determine Full Retirement Age (FRA)

- Effects of marriage and divorce

- Implications of collecting before FRA vs. collecting at FRA vs. collecting after FRA

- Annual limits

- Impact if continuing to work

- How benefits will be taxed

- Updated for 2020

SECURE Act

You may have unique circumstances that result in a possible impact on the taxes (and penalties) that must be paid if a distribution is taken from your Traditional IRA.

*Roth IRA distribution rules are slightly different.

SECURE Act

IRA Distributions

Will A Distribution From My Traditional IRA Be Penalty Free

You may have unique circumstances that result in a possible impact on the taxes (and penalties) that must be paid if a distribution is taken from your Traditional IRA. The exceptions to the usual distribution rules can be hard to remember especially since many exceptions rarely come up.

To help make this easier, we have created the “Will A Distribution From My Traditional IRA Be Penalty Free?” This flowchart helps to quickly identify unique situations that could have an impact on how a distribution is taxed (and penalized):

- Implications for IRAs with nondeductible IRA contributions

- Conditions that trigger the 10% early distribution penalty.

- Situations that avoid the 10% early distribution penalty

- Updated for 2020 (including The SECURE ACT)