How to Setup Your BayRock Plan

There are a few key steps in setting up your plan in BayRock and in this post, I’ll outline the steps and some information to help you get the most out of your experience. This article is intended for Students of Personal Finance at the Bauer College of Business at University of Houston. However, the steps outlined below will help you get started whether you’re a UH Student or a BayRock client, or if you’re just wanting to follow along and build your first financial plan, welcome!

Getting Started

-

Subscribe to our Podcast in iTunes and everywhere Podcasts are played

-

Update Your Plan

Jump in and start tracking your financial progress right away. Once you get started , I’ll be able to see monitor your activity from my advisor dashboard.

-

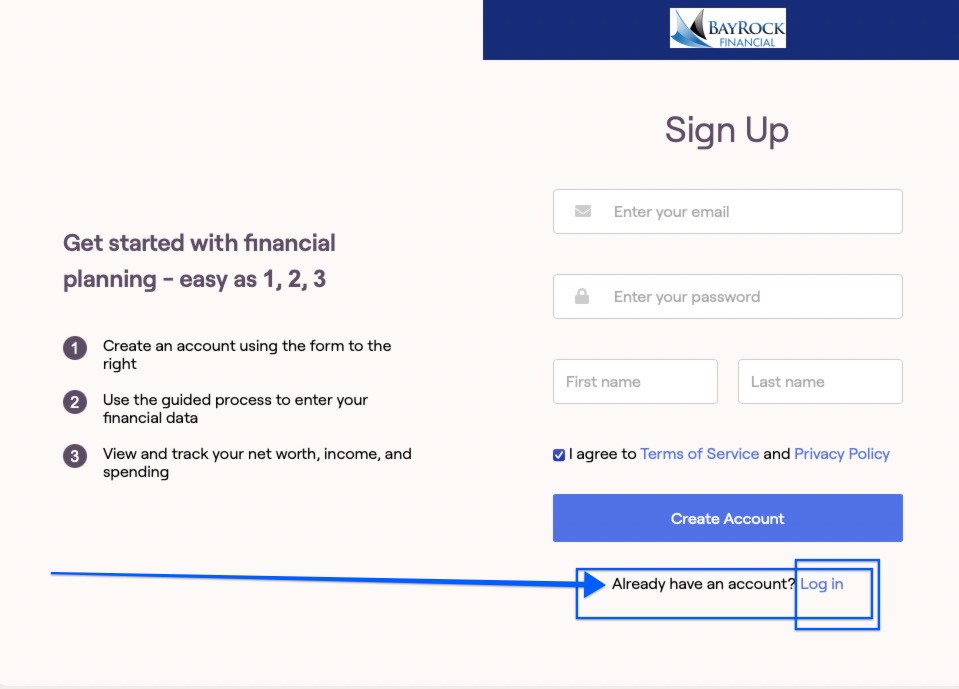

You will be prompted to enter a password and create an account.

-

Please bookmark the page and be sure to save your password.

-

For your convenience, we’ve included easy links at the top of our pages and posts on our websites at BayRock Financial and also at Missional Money.

Download the RightCapital Mobile App

The RightCapital mobile app is available for iPhone and Android devices. Clients can visit the App Store or Google Play store to download the App.

RightCapital mobile app download links:

Apple App Store download

Search for RightCapital

-

Click the blue Get button

-

Once the download is complete, click the blue Open button

-

Insert your login information when prompted

Google Play Store download

BayRock and RightCapital Mobile App

-

Search for RightCapital

-

Click the green Install button

-

Once the download is complete, click the green Open button

-

Login using the same email and password you used to create your account in previous step.

Give RightCapital Permission

Plan Summary and Navigation

What’s In Your Financial Plan

Important Message!

After you create an account with BayRock, your plan will be set up. However, please note that a BayRock team member will need to make changes to your plan in order to give you access to the “data cards” you will need to create a comprehensive financial plan in the BayRock Planning Portal. Below, we’ve listed all of the data cards that are available – but you will not see these elements until after you create your account and someone at BayRock updates your plan to give you the needed permissions.

The Dashboard

-

Snapshot

-

Balance Sheet

-

Liquidity

-

Budget

-

Debt

-

Student Loan

-

Tasks

Investment

-

Asset Allocation

-

Allocation Path

-

Sector and Style

-

Concentration

-

Tax Allocation

-

Holdings

Retirement

-

Analysis

-

Stress Test

-

Social Security

-

Medicare

-

Cash Flows

Insurance

-

Life Insurance

-

Disability

-

Long-Term Care

-

Property and Casualty

Education

Tax

-

Tax Estimate

-

Distributions

Estate

-

Checklist

-

Beneficiary

-

Analysis

Profile

-

Net Worth

-

Goals

-

Income

-

Savings

-

Expenses

-

Family

More

-

Vault

-

Calculator

A Few Things We Can Do in Your Financial Plan

-

Social Security Optimization

-

Budget Planning

-

Student Loan & Debt Management

-

Tax Planning & Roth Conversion Optimization

-

Annuity Analysis

-

Insurance Needs Analysis

-

Goal Based Planning

-

Advanced Cash Flow Planning

-

Retirement Planning Analysis

-

Retirement Income Analysis

-

Interactive Scenario Planning

-

Estate Planning Strategies

-

High Net Worth Estate Planning

-

Monte Carlo Simulations

-

Medicare Planning & Premium Calculation

-

Dynamic Retirement Spending Strategies

-

Business Exit Strategies

-

Holdings Details

-

Client Portal and Document Vault

-

Account Aggregation

-

Spending & Budgeting Tools

-

Mobile App

-

And Much More!

Jim Munchbach, CFP®, CLU®, ChFC®, CPCU®

I look forward to helping you create a compelling financial plan for your future. Missional Money is a weekly podcast where you’ll get tips, tools, and strategies to Make Your Money Count. Much of what you will learn in Money Study Group is based on my book (Make Your Money Count).

Missional Money Podcast

Join Jim Munchbach and Mr. Cartoon Head for Season Two of the Missional Money Podcast in iTunes, Spotify, Casbox, Podchaser, and Everywhere Podcasts are played!