Tax Planning Strategies: Minimize Your Tax Liabilities with an Independent Fiduciary Advisor

Tax planning strategies can help you minimize your tax liabilities. At BayRock Financial, you work with an experienced Independent Fiduciary Advisor who specializes in tax planning, providing personalized strategies and coordination with your advisory team to optimize your tax situation. Learn how our independent fiduciary advisor can help you connect all the dots in your financial plan.

Tax Planning Gap Analysis

Tax planning strategies play a vital role in minimizing your tax liabilities and maximizing your after-tax income. At BayRock Financial, we understand the significance of tax planning and the need for comprehensive coordination within your financial plan. Let’s explore how our independent fiduciary advisor can help you develop personalized tax strategies that connect all the dots in your financial plan.

The Benefits of Working with an Independent Fiduciary Advisor

Working with an independent fiduciary advisor offers numerous benefits, including:

-

Unbiased Advice: An independent fiduciary advisor acts in your best interest, providing unbiased advice that is free from conflicts of interest. Their focus is solely on helping you achieve your financial goals and minimizing your tax liabilities.

-

Thoughtful Gap Analysis: An independent fiduciary advisor conducts a thoughtful gap analysis to evaluate your current financial situation and identify areas where your goals may not align with your resources. This analysis provides valuable insights that guide the development of personalized tax strategies.

-

Advisor Coordination: Advisor coordination is key to a well-coordinated financial plan. Unfortunately, there is often a disconnect among professionals in different financial disciplines. An independent fiduciary advisor bridges that gap by facilitating communication and collaboration among your financial team.

-

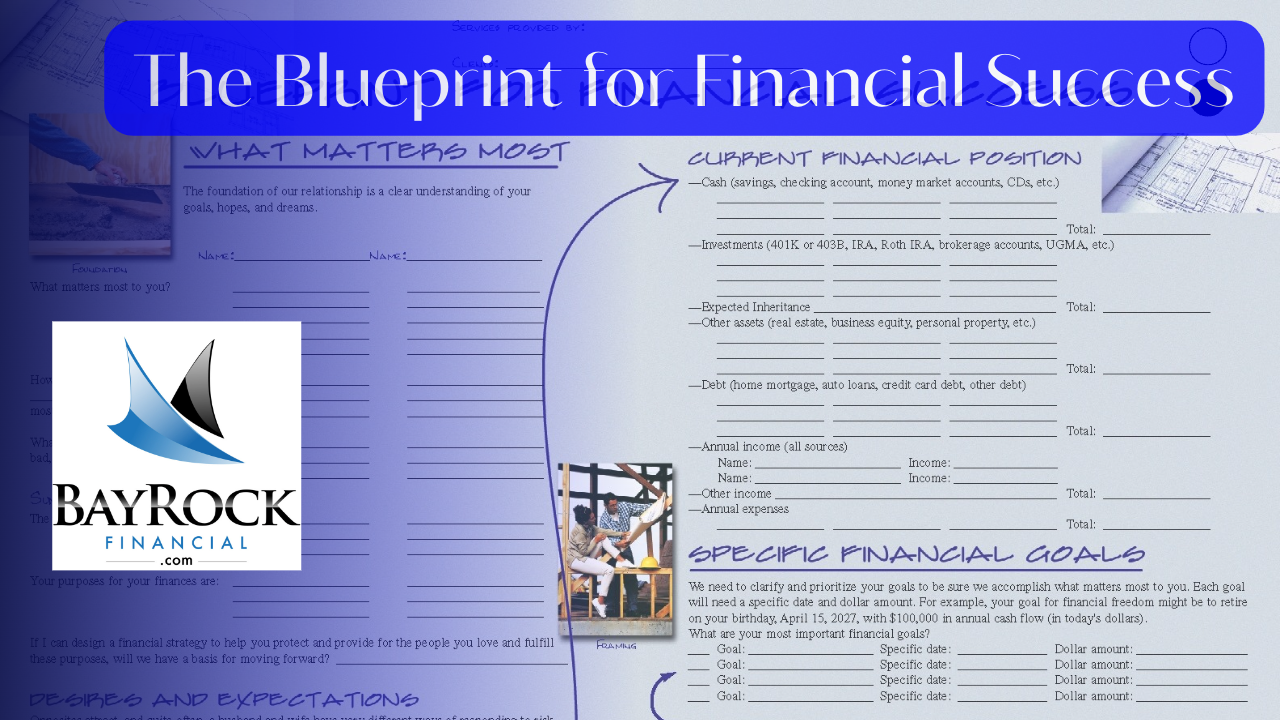

Holistic Financial Blueprint: An independent fiduciary advisor helps you create a holistic financial blueprint that connects all the essential elements of your financial plan.

By considering retirement planning, risk management and insurance planning, estate planning, education planning, tax planning strategies, investment management strategies, and cash flow management, they ensure that all the dots are connected in the right scope and sequence.

Comprehensive Tax Planning Strategies

Effective tax planning strategies encompass various elements of your financial plan. Our independent fiduciary advisor can assist you in developing personalized tax strategies for:

Retirement Planning

Planning for retirement includes tax-efficient retirement account contributions, withdrawals, and distribution strategies to minimize tax liabilities during your retirement years.

Risk Management and Insurance Planning

Analyzing your insurance coverage and implementing tax-efficient strategies to protect your assets while minimizing your tax liabilities.

Estate Planning

Developing estate planning strategies that minimize estate taxes and ensure efficient wealth transfer to your beneficiaries.

Education Planning

Utilizing tax-advantaged education savings accounts and exploring education tax credits to optimize your education planning strategies.

Investment Management Strategies

Developing tax-efficient investment strategies, such as tax-loss harvesting and asset location optimization, to minimize the tax impact on your investment returns.

Cash Flow Management

Optimizing your cash flow to maximize tax efficiency by managing your income and expenses strategically.

Tax Planning Strategies

Analyzing your overall tax situation, maximizing deductions and credits, and implementing strategies to minimize your tax liabilities in a legal and efficient manner.

Tax planning strategies are essential for minimizing your tax liabilities and maximizing your after-tax income. At BayRock Financial, our independent fiduciary advisor specializes in tax planning and provides unbiased advice and personalized strategies that connect all the dots in your financial plan. Contact us today to learn more about how our advisor can help you develop comprehensive tax strategies tailored to your unique circumstances.

Contact us Anytime #AskMeAnything. At Bayrock Financial we’re here when you’re ready to start your retirement planning journey and take a step closer to financial independence.