Can I Contribute To My Roth IRA

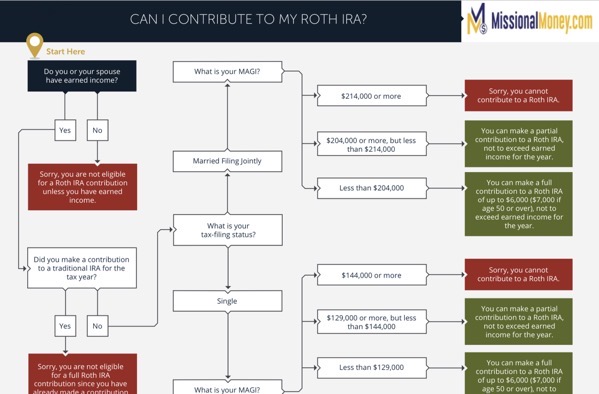

Can I Contribute To My Roth IRA? A Roth IRA is a great option for you who is looking to save after-tax dollars, offering the opportunity for tax-free growth and relaxed distribution rules. Unfortunately, eligibility to contribute to a Roth IRA is subject to restrictions, which can cause confusion.

To help make the analysis easier, we have created the “Can I Contribute To My Roth IRA” flowchart. It addresses the key eligibility considerations, including:

-

Earned income

-

Other (traditional) IRA contributions

-

Filing status-based MAGI thresholds

Instant Download: Contributing To My Roth IRA

A Roth IRA is an IRA that, except as explained below, is subject to the rules that apply to a traditional IRA.

-

You cannot deduct contributions to a Roth IRA.

-

If you satisfy the requirements, qualified distributions are tax-free.

-

You can make contributions to your Roth IRA after you reach age 70 ½.

-

You can leave amounts in your Roth IRA as long as you live.

-

The account or annuity must be designated as a Roth IRA when it is set up.

The same combined contribution limit applies to all of your Roth and traditional IRAs.

Limits on Roth IRA contributions based on modified AGI

Your Roth IRA contribution might be limited based on your filing status and income.

- 2023 – Amount of Roth IRA Contributions You Can Make for 2023

- 2022 – Amount of Roth IRA Contributions You Can Make for 2022

Additional resources

- Details about Roth IRAs are contained in Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) and Publication 590-B, Distributions from Individual Retirement Arrangements (IRAs) and include:

- Setting up your Roth IRA;

- Contributions to your Roth IRA; and

- Distributions (withdrawals) from your Roth IRA.

- Differences Between Roth IRAs and Designated Roth Accounts

- Individual Retirement Arrangements (IRAs)

Can I Contribute To My Roth IRA Overview

Can I Contribute To My Roth IRA – Start Here: Do you or your spouse have earned income?

Can I Contribute To My Roth IRA – Did you make a contribution to a traditional IRA for the tax year?

Can I Contribute To My Roth IRA – what is your tax-filing status?

Can I Contribute To My Roth IRA If YES, how much?